DACH buyout dealflow hits 15-month high in Q2

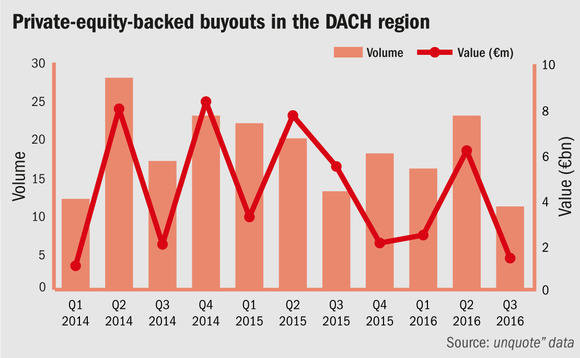

The DACH region witnessed a surge in buyout dealflow in the second quarter of 2016 according to unquote" data, with a particularly noticeable increase in the aggregate value of transactions.

The German-speaking region was home to 23 recorded buyout deals between April and June, amounting to an estimated aggregate enterprise value of €6.1bn. These figures mark a sharp increase on activity in the first quarter, with volume up by 43% and aggregate value up by a staggering 155%.

The latter can be explained by a healthy number of transactions valued in excess of €250m, as well as a handful of large-cap deals inked in the quarter. EQT notably acquired the real estate services business of German engineering company Bilfinger for €1.4bn EV in June, while Astorg Partners bought a majority stake in Switzerland-based AutoForm for a reported CHF 700m (€648.6m) that same month.

Slightly lower down the value scale, 3i acquired German cable protection producer Schlemmer from Hannover Finanz and Mackprang Holding in a deal thought to value the company at more than €400m. Quilvest Private Equity also sold Swiss watch component maker Acrotec Group to Castik Capital in a CHF 280m SBO.

This strong activity means the DACH region saw its busiest quarter in terms of buyout dealflow since Q4 2014, while aggregate value hit a high not seen since the €7.6bn recorded in Q2 2015.

Germany and its neighbouring countries also outpaced the rest of Europe with regard to buyout dealflow in the second quarter. Looking at Europe as a whole, the number of buyouts recorded went up by 11% while overall value increased by 80% quarter-on-quarter.

Click here to download the Q2 2016 Private Equity Barometer, published in association with SL Capital Partners, to get complete statistics on European private equity activity in the second quarter

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds