GP Profile: PAI Partners

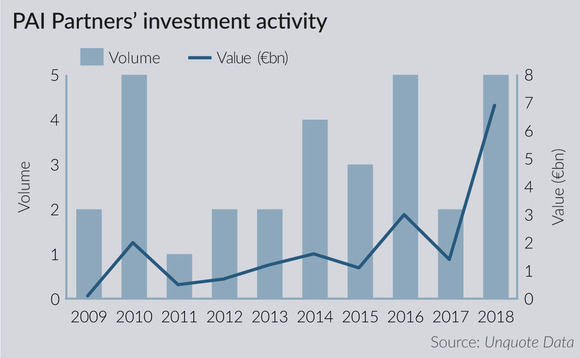

In 2018, French large-cap private equity house PAI Partners completed five deals and raised a €5bn fund. Partner Ivan Massonnat discusses the firm's current strategy and future direction in the face of a trend of GP consolidation in France

"We like complexity and acquire companies that are ready for an important transformational process," says Ivan Massonnat, partner at PAI Partners. A key part of this transformation is acquisitive growth strategies. The last two funds completed 20 platform deals, which entailed more than 190 add-ons, setting out large consolidation projects. Changing the management team is also a recurring theme, with 60% of portfolio companies seeing a change in CEO and, in some cases, this is from day one.

The investment in French private nursing homes operator DomusVi is an example of the international growth PAI targets. During the GP's three-year holding period, DomusVi made a number of bolt-ons and grew from a purely French provider into the third largest nursing homes operator in Europe and the largest in Spain. The business generated a money multiple of 3.3x for PAI when it was reacquired by its founder with support from Intermediate Capital Group in 2017.

PAI concentrates on five main sectors: food and consumer, business services, healthcare, general industrial, and retail and distribution. The firm's deal value range is €300m-2bn, with the sweet spot being just less than €1bn. It typically invests equity tickets in the €200–400m range. Massonnat says PAI has a long history of corporate partnerships where "the previous owner reinvests alongside PAI, which, in turn, allows us to buy companies at a reasonable price, at an average of 7x EBITDA".

International investors somewhat disregarded France at the time we raised Fund VI, whereas the impact of the Macron election was a catalyst for changing investors' sentiment" – Ivan Massonnat, PAI Partners

In terms of returns, PAI has made nine exits since the beginning of 2017, of which four generated money multiples of around 3x. The firm says it has realised very few losses since its inception and zero in the last two funds.

In the 1990s, PAI became one of the first mid-to-large French GPs to make deals abroad. "Today, with seven offices across Europe and one office in the US, we are a pan-European investor that operates in highly fragmented European markets," says Massonnat. "Many of our competitors have been either from the US or have been London-based."

What a difference three years makes

Massonnat explains that the marketing of the latest two funds were very different experiences. PAI Europe VI launched in 2013 and closed on €3.3bn in early 2015. In contrast, PAI Europe VII closed on €5bn in 2018 after just a few months on the road and had demand of around €15bn. "The two fundraisings notably took place at times with opposite macroeconomic environments," he says.

"International investors somewhat disregarded France at the time we raised Fund VI," says Massonnat, "whereas the impact of the Macron election was a catalyst for changing investors' sentiment regarding France and continental Europe. The fact that PAI showed strict discipline on its fund size was, in itself, very attractive for LPs, given the general market environment."

However, the firm has not altered its approach to co-investment, says Massonat. "We have always provided co-investment opportunities for our LPs. In our last fundraising effort it was important to attract commitments from large international North American, Asian and Middle-Eastern LPs. These are the most scalable players, able to commit tickets of around €500m."

Of PAI Europe VI's 17 deals, nine included co-investment from LPs. PAI Europe VII is expected to replicate the strategy, and the first investment, France-based games company Asmodée, includes an equity syndication to LPs. A recent example of PAI's co-investment activity is the €3.4bn take-private of Refresco in March, alongside the British Columbia Investment Management Corporation.

In very specific situations, PAI has co-invested with other GPs: it acquired Cortefiel alongside CVC Capital Partners in July 2017, and World Freight Company International alongside Baring Private Equity Asia in May this year.

Up against the big hitters

Co-investments also allow PAI to compete in a market where M&A activity is continually creating larger players, without having to go through its own consolidation process. GP consolidation has been common in France in recent years, and Massonnat says the trend could be a sign of the maturity of the country's market.

"There's no urgent need to diversify for us," says Massonnat. "We have ample investment opportunities within our core LBO mandate." However, he adds: "We are regularly approached by companies that want to join the PAI platform. Nonetheless, for a number of reasons, we decided a consolidation strategy would not be in our best interests. Not for the time being."

Key People

• Ivan Massonnat rejoined PAI from Fondations Capital in 2010 and is a partner on the investor and ESG teams at the firm. His initial stint at PAI started in 2000, when he joined as a member of the investment group before moving into investor relations and fundraising activities in 2004. He joined Fondations Capital as a partner in 2008.

• Michel Paris has been CEO since 2015 and was chief investment officer between 2009-2016. Joining PAI in 1984, he has been involved in a large number of transactions, including Sogeres, Bouygues Telecom, Atos, Equant, Elior, Frans Bonhomme and Kiloutou. He started his career by spending two years with Valeo.

• Patrick Mouterde joined PAI in 1998 as a member of the finance team, and became CFO in 2006. He started his career at Arthur Andersen as a manager in the audit department, where he spent eight years.

• Frédéric Stévenin is chief investment officer and a partner managing the food & consumer and healthcare sector teams. He first joined PAI in 1993 and spent five years in the food & beverage sector team. In 1998, he joined Deutsche Bank and Bankers Trust in the European acquisition finance group as a director, and subsequently as managing director. He returned to PAI in June 2001.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds