French sponsor-led deal flow pushes through despite war in Ukraine stalling some auctions

The French M&A pipeline may well struggle to remain dynamic amidst adverse macroeconomic conditions heightened by the war in Ukraine, but France is seeing a resilient flow of sponsor-led deals, local dealmakers said.

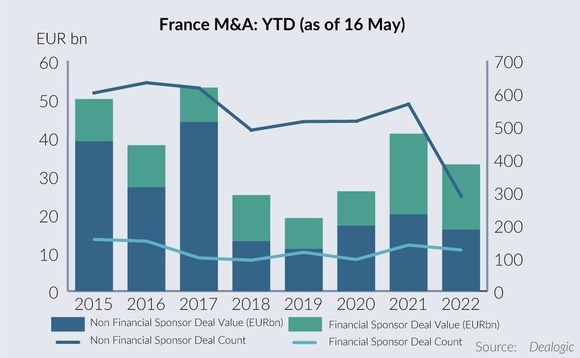

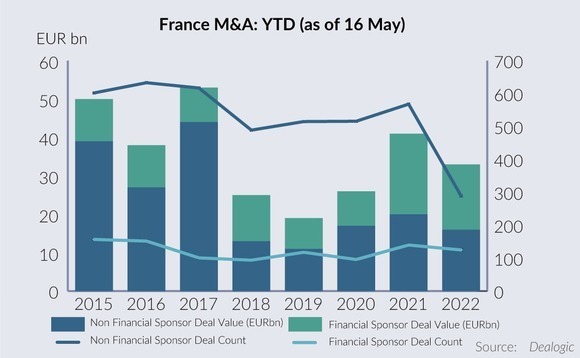

Year-to-date French M&A volume this year was down by around 42% (403 from 707 last year for the same period) and 21% in value (EUR 31.7bn, from EUR 41.3bn last year), Dealogic data showed.

Despite the current market jitters, YTD sponsor-led transactions value have so far seen the second highest performing year since 2015. The record year was 2021, YTD sponsor-led deals' value reached EUR 21bn for 140 deals according to Dealogic.

"The war has had a significant impact on transactions. Today, it is more difficult to draft a business plan or to assess a company's valuation," Deloitte M&A Advisory partner Charles Bédier said.

The current decline in M&A activity is due to a "wait-and-see" stance on the part of buyers where there are uncertainties about some key investment parameters, he added.

However, YTD 2022 financial sponsor-led deals represented close to 52% of the deal volume at EUR 17bn for 122 deals (30% of the total number of deals registered so far) according to Dealogic.

| Year | Non Financial Sponsor Deal Value (EURbn) | Non Financial Sponsor Deal Count | Financial Sponsor Deal Value (EURbn) | Financial Sponsor Deal Count |

| 2015 | 39 | 602 | 11 | 157 |

| 2016 | 27 | 633 | 11 | 152 |

| 2017 | 44 | 617 | 9 | 101 |

| 2018 | 13 | 489 | 12 | 94 |

| 2019 | 11 | 515 | 8 | 118 |

| 2020 | 17 | 516 | 9 | 96 |

| 2021 | 20 | 568 | 21 | 140 |

| 2022 | 16 | 289 | 17 | 125 |

Source: Dealogic

The challenging market conditions heightened by the war in Ukraine have so far resulted mainly in a negative impact in the retail and industrial sectors, which are more exposed to the rise in commodities prices, or on companies with activities in Ukraine and Russia, a Paris based M&A banker and a French M&A lawyer agreed.

"What key players need to keep an eye on is the current combination of market volatility and inflation which could deter potential investors," Bédier noted.

Risk-averse sponsor investment

Exposure to the Russian market has become a clear disadvantage for consumer-oriented companies as investors are growing wary of a market under heavy sanctions following the war. French PE firm Weinberg Capital Partners chose to trigger a Material Adverse Change (MAC) clause after it was awarded exclusivity for the acquisition of French maker of skincare and beauty products Payot. It eventually dropped out of the process as the company generates between 20% to 30% of turnover in Russia.

On February 18th, Kingspan Group announced that it entered exclusive negotiations to acquire French specialist in roofing and building waterproofing solutions Ondura for EUR 550m. Since then, two sources familiar told Mergermarket the deal might have gone cold, citing the company's exposition to Russia.

In the food sector, companies had to contend with the rising costs of raw materials. This February, the founding family of French bakery chain Marie Blachère mandated Crédit Agricole CIB and Centerview Partners for a sale that would have valued the business over EUR 1bn, as reported, a process which was eventually paused. French savoury snacks producer Europe Snacks, which was reported as a candidate for a 2022 exit, could also be delayed as well as due to the war, one source familiar told Unquote sister publication Mergermarket. PAI Partners-owned French food producer Ecotone was expected to be put on the block this year. The EUR 80m-100m EBITDA business would instead hit the market next year, one source familiar told this news service, another one saying that the process was iced following the Russian invasion of Ukraine.

Supply chain experts have also suffered from the conflict, as shown by the interruption of the USD 1.5-USD 2bn sale of French manager of cargo freight capacity World Freight Company International this March. Current sponsors PAI Partners and Baring Private Equity Asia called off the sale process due to ailing market conditions.

Mitigating the energy crisis

As access to debt financing is getting more complicated with the expected interest rate raise by the European Central Bank to respond to the acceleration of inflation and sluggish economic growth perspectives, French M&A practitioners want to remain optimistic.

While year-on-year inflation rate for the Eurozone stood at 7.5% on average, France registered one of the lowest inflation rate increases in the region - at around 5% according to the European Commission statistics agency.

The resilience of France is partly to be explained by its nuclear industry and some of the exceptional measures introduced by the government in order to put a cap on rising energy prices, a banker highlighted. France is less reliant on gas and oil, with its electricity generated at 67% from nuclear energy according to the French government.

French utility EDF, 83.88% owned by the French state, completed last month a successful a EUR 3.1bn rights issue to help it fund new investments and to relieve the cost pressure of a French government policy to cap domestic energy prices and to curb nuclear power output.

The need for Europe to be independent from Russian energy is also seen as validating EDF's strategy, as earlier reported by this news service.

An infra-backed resilience

France's deal flow this year will continue to be pushed along by transactions in the TMT, healthcare, infrastructure, and energy sectors which are less exposed to macroeconomic headwinds, a Paris-based M&A banker said.

"Healthcare will stay strong no matter what, as well as utilities, telecom and business services, including facility management, and tech but likely at lower valuation levels," Bédier added.

The infra pipeline remains face-paced and includes French state-controlled railway group SNCF plans to receive non-binding offers for its locomotive lessor business Akiem by early June. French retailer Groupe Casino launched a process to sell its alternative energy producer GreenYellow, which could be worth EUR 1.5bn. The sale, conducted by HSBC and Crédit Agricole, is said to attract interest from French energy groups TotalEnergies and Engie, as well as Portuguese peer EDP and private equity funds EQT, Blackstone, Ardian, and KKR.

A resilient deal flow is observed in healthcare with the sale of French beauty and wellbeing products manufacturer Havea, expected to start this quarter. Concurrently, French sponsor Montagu aims to start to exit its French food supplement portfolio company Arkopharma during 2Q22, as reported by Mergermarket.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds