Competition, maturity drive swell in French VC investments

Startups in Paris continue to attract larger venture investments; can the French capital overtake more prominent European venture hubs such as London and Berlin? Greg Gille reports

London or Berlin may turn more heads when it comes to their striving startup environment, but could Paris be well on the way to catch up or even surpass these tech capitals? For years, local practitioners have extolled the virtues of the French venture space, which they claim is characterised by a high level of maturity, a healthy number of entrepreneurs and startups, and a favourable ecosystem to support them.

Judging by the capital deployed in French venture deals last year, investors are certainly paying attention – and more importantly, they are increasingly eager to deploy larger equity tickets into these businesses.

According to unquote" data, the country was home to 218 venture deals valued in excess of €500,000 last year, which shows an encouraging 8% hike over the already improved 2014 figure. Furthermore, the aggregate value of these early-stage and expansion rounds went up by a massive 59%, to settle on €1.9bn by year-end. Clearly, the amount of capital deployed significantly outpaced the more modest increase in dealflow, meaning the average value of French venture deals went from €5.9m in 2014 to €8.7m last year.

Delving down into the figures shows that larger rounds (valued at €20m and more) registered a 30% increase in dealflow and an even more impressive 70% increase in aggregate value, with an average deal value of €43m as opposed to €33m in 2014, suggesting once again that later-stage rounds recorded a significant uptick value-wise last year. It must be noted that this was significantly boosted by two exceptionally large rounds (€100m for cellular network operator Sigfox in March and a $200m series-D for car-sharing service BlaBlaCar in October), which drove the average up but also highlights the ability of French tech businesses to attract Silicon-Valley-like levels of funding.

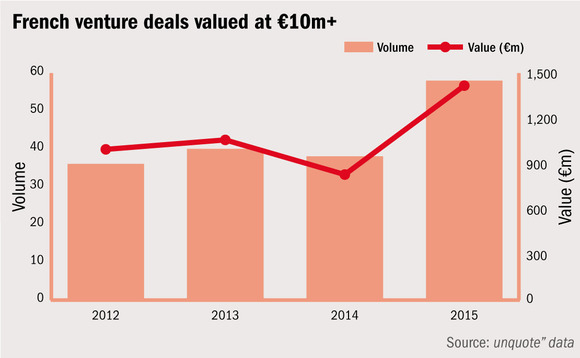

It is not just mega-rounds that boosted the overall 2015 VC figures, though. The increase in deals valued in the €10-20m space actually outpaced that seen in the larger bracket (+40% in volume terms to 39 transactions). The same goes for the €5-10m bracket (+34% to 47 transactions), arguably a sweet spot for measuring investor appetite at series-C and beyond. Clearly, swelling funding rounds cannot be solely attributed to an uptick at the larger end of the market.

First come, first served

Tech-focused corporate finance house Clipperton Finance has observed the same phenomenon in its own activity barometer. Partner Stéphane Valorge highlights that this is likely due to both the health of the French startup space and a wider movement towards pricier assets in M&A. "There has been an evolution with regards to the maturity of French tech companies, leading to more competition and a general upwards movement for valuations," he says. "These businesses are starting to monetise their models and create value, and this is not going unnoticed."

This pool of attractive opportunities is being met by an increasingly diverse investor base as well, driving up competition and therefore valuations. "Not only are we seeing more competition, but the diversity is also greater: strategic players are coming back, high-net-worth individuals and family offices are gaining ground, and private equity players tend to dip further down into the growth capital area," says Valorge.

Vestiaire Collective's €33m round, inked in August, illustrates this trend neatly. On the one hand, it featured private equity firm Eurazeo deploying €20m via its Croissance arm. The online marketplace, founded relatively recently in 2009, also attracted the corporate venturing arm of publishing business Conde Nast.

US investors are also making an impact on the French market at the moment, following their last big incursion in the country around the 2005-2007 period. "The fact that Goldman Sachs invested such a large ticket in Talentsoft back in October is an impressive sign in that regard," Valorge notes. Goldman Sachs' private equity arm invested €25m in cloud-based HR software developer Talentsoft in October, following in the footsteps of Union Square Ventures taking part in a €8m series-B round for food online marketplace La Ruche Qui Dit Oui in June – the latter deal marked Union Square's second investment in the European market and its first ever in a French company.

Following such a standout year, can French VC's performance be replicated in 2016? Valorge believes the upwards trajectory should continue, despite some clouds on the horizon: "Macroeconomic risks will remain in 2016, of course, but, looking purely at the tech sector, most indicators are in the green. There remains a significant amount of liquidity in that space, and we anticipate Chinese funds will ramp up their activity there in the coming months. The dearth of IPOs and the race to back 'unicorns' in the US can be causes for concern though: a bubble building up and eventually bursting would invariably have an impact on Europe."

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds