Corvm Capital becomes Canopia Capital Partners

French private equity mid-market fund Corvm Capital has rebranded itself as Canopia Capital Parnters, continuing its geographical and commercial expansion.

The change of identity, which comes two years after the firm's creation, is the sign of a new development phase, the GP said in a statement, aimed at making the group more recognisable and visible, symbolising its philosophy to promote growth in a protective environment.

It is hoped the rebrand will help the group gain visibility and strengthen its presence within its two key markets: SMEs expanding internationally, and major European and US groups divesting mid-market companies.

The rebranding also marks the entrance of a new minority shareholder in the group. The investor, whose identity has not been disclosed, is a Belgian company mostly active within the legal sphere, and which invested in Corvm via a foreign holding, a source familiar with the matter told unquote".

It also marks a further investment in human resources, with the planned recruitment of two new sector experts by the end of the year, bringing the team up to a total of nine. In the preceeding years, Canopia set up two new offices in Paris and New York – one dedicated to the EU market, and the other to SMEs in North Africa. It also expanded its team with the recruitment of four senior advisers and two junior executives.

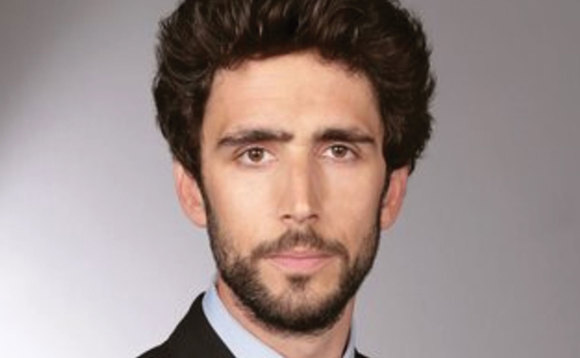

Corvm was launched in late 2014 by former HIG senior associate Arthur Dessenante targeting the European and US mid-markets with a deal-by-deal fundraising model. The firm targets two pools of potential co-investors: private equity funds (65%), and family offices or other partners (35%).

The firm targets companies with turnovers ranging between €50-500m.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds