Nordic exits facing slump in 2016

Nordic VC and private equity exit volume is on track to hit a five-year low without a substantial surge in Q4. Mikkel Stern-Peltz reports

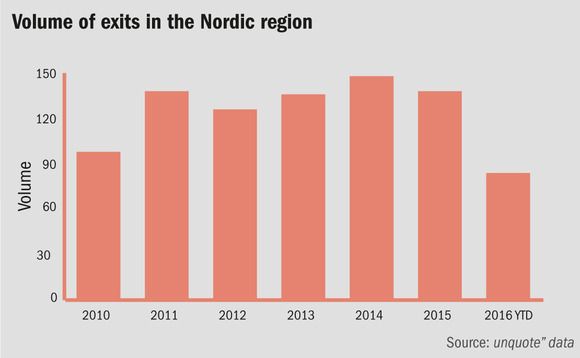

Despite strong market conditions earlier in the year, exit activity from Nordic private equity and venture capital fiirms is facing a potential five-year low, according to unquote" data.

Nordic GPs and VCs have completed 83 exits so far in 2016, compared to 139 last year and the five-year high watermark of 153 in 2011. At the time of publication, the region is 51 exits short of the 134 sales completed in 2012, which was the lowest amount seen in the Nordic market in the past half-decade.

The fourth quarter of 2016 would have to be one of the most active three-month periods in a decade if Nordic VC and private equity activity is to avoid falling short of that target: since 2006, only three quarters have seen more than 50 exits. GPs would do well to repeat last year's final quarter, which saw 52 portfolio companies sold in what was 2015's most active period.

If we are seeing a lack of exit opportunities, it is probably a reflection of a lack of quality in some portfolios" – Harald Mix, Altor

The Nordic exit slowdown comes despite supposedly immaculate conditions for managers to sell their assets with high returns. "Exit markets are almost perfect," Altor founder and managing partner Harald Mix said at the Nordic Private Equity Summit in June.

"The only thing to stop you from tapping the market is having bought at the wrong time in the last cycle. If we are seeing a lack of exit opportunities, it is probably a reflection of a lack of quality in some portfolios," he said during a panel discussion, in response to market data showing the Nordic region had seen more entries than exits in the 12 months to June 2016. "It's very difficult to see better conditions for exits than what we have today," Mix said at the time.

Since Mix's statement, the trend has been reversed: according to the latest tally from unquote" data, exits are currently outpacing buyouts and other non-VC investments in the Nordic market, with 75 deals registered against 83 exits - though the exit figures also include VC-backed companies and partial exits such as share sales.

The long wait

The Nordic market has fielded several large exits this year and public markets have supported a handful of substantial IPOs in 2016. Five exits worth in excess of €500m have taken place so far this year, four of which had an EV of €1bn or more – including the fourth largest Nordic exit for a quarter of a century and the region's largest IPO for six years, the DKK 30bn flotation of Danish payments provider Nets by Bain Capital Europe and Advent International.

Similarly, both secondary buyouts and trade sales have provided ample returns for exiting investors, suggesting the exit window has remained wide open for most of the year.

The loss of volume in the exit market may be due in part to volatility leaking into the Nordic economies. Nordic economists, business leaders and analysts have warned that the UK's vote to leave the EU could negatively affect certain parts of the Nordic economies, due to increased overall volatility as well as diminished exports and currency weakness.

As exit volumes have declined compared to last year, asset age has increased by an average of 16 months. The average holding period for a private-equity- or venture-backed company exited in 2015 was five years and four months, compared to an average of six years and eight months for 2016. This is also 10 months longer than the average holding period in 2014, at five years and 10 months, and a six-month increase on the 2013-average of six years and two months.

While possible reasons for the increase in hold and decrease in activity are legion, given the talk of frothy entry multiple pricing for Nordic GPs heard in the past two years, one explanation could be that funds are holding off on selling their portfolio companies in the hope of slightly higher exit multiples – in part to compensate for the increase in entry multiples seen across the Nordic buyout space in recent years.

What remains to be seen is whether the exit window remains open for a Q4 surge, or if exits in the Nordic market will face a challenging end to the year.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds