Mega-funds ignite Nordic nations

With the fourth quarter of 2018 yet to come, Nordic private equity funds have raised a record amount of money in a calendar year, thanks in large part to a mid-market that is coming of age. Gareth Morgan reports

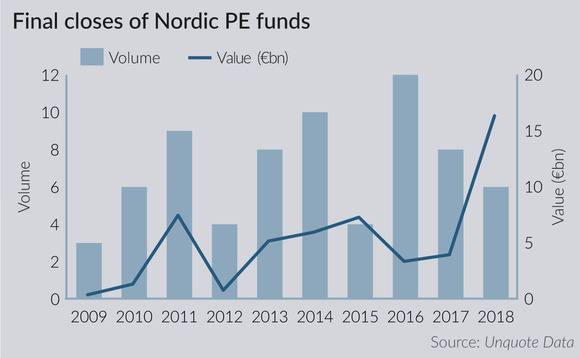

The Nordic region has seen a significant jump in private equity fundraising in 2018, with €20.1bn secured over the first nine months of the year and 11 funds holding a final close. These numbers dwarf previous years for the region, where totals have tended to fluctuate around a mean of €7.2bn for the five years between 2013-2017.

The largest fund to close in the first three quarters of 2018 was pan-European vehicle EQT VIII, which secured €10.75bn in February, an increase of €4bn on the GP's previous flagship offering. Following this was €4.3bn fund Nordic Capital IX, which closed in May 2018 after seven months on the road. Collectively, these two large-cap funds make up 75% of the Nordic market for 2018, a fact that at first glance seems remarkable. But the long history of private equity in the region has offered the opportunity for firms to grow from large regional players into significant pan-European and even global managers.

This has meant that, when looking at the region as a whole, fundraising numbers are often meaningfully impacted by the activity of these firms raising very large funds.

To illustrate this, looking at the five-year period from 2013-2017, the percentage of aggregate commitments in the market accounted for by €1bn+ funds is 59%, with total amounts raised varying from 15% in 2016 to 88% the previous year. Notably, this metric for 2016 and 2017 was significantly lower than in previous years, highlighting an uptick in activity in the mid-market space.

Scoring a brace

During 2017, 18 funds held a final close raising a cumulative total of €6.5bn, with the mid-market following on from 2016 and chalking up a strong showing. The two largest funds closed during the year were both EQT-managed vehicles: €1.6bn vehicle EQT Mid Market Europe hit its hard-cap in May, and EQT Credit III closed on €1.3bn in December. Notably, 2016 and 2017 are the only two years since 2013 in which the largest fund to hold a final close in the region raised less than €2bn, a fact reflected in the lower average fund size for each year. However, it is also notable that the aggregate amounts raised in these two years was not meaningfully down on previous years, a fact explained by the uptick of activity from mid-market managers.

In the €150m-1bn space, 10 funds held a final close during 2017, raising a total of €3.27bn. This follows a strong 2016 for the mid-market, during which 14 funds raised €4.83bn. These two years mark a significant increase on previous years, reflecting the impact that strong historical performance in the region has had in attracting the attention of international LPs.

As a region, the Nordic countries are probably the most accepting of private equity across Europe" – Edward Hutton, Campbell Lutyens

"The Nordic market continues to be perceived as an attractive market by LPs," says Adalbjörn Stefansson, head of investor relations at Adelis Equity Partners. "Many already have some exposure to the region, and no-one I've spoken to is looking to scale down."

Although the region's larger managers have historically enjoyed attention from international LPs, this has trickled down to core mid-market players. Says Stefansson: "LPs are actively looking for mid-market exposure, particularly European LPs that have been exposed to the Nordic countries for some time and are building out their mid-market portfolio."

Unquote reported recently on private equity outperforming other asset classes for Nordic-based LPs, many of which were increasing their allocation to the strategy. Many factors were cited for this increasing appetite, including the contribution from PE firms towards developing sustainable companies.

Making hay

The track record of the industry, as with the fortunes of private equity markets the world over, is closely tied to economic and cultural factors, both of which are particularly conducive to private equity activity in the Nordic region. "As a region, the Nordic countries are probably the most accepting of private equity across Europe," says Edward Hutton, partner at Campbell Lutyens.

Dealflow in the region is supported by corporate spin-outs, which contributed €1.41bn in deal value in the first three quarters of 2018. Alongside this, corporate divestiture also provides a rich stream of management talent that astute private equity firms have been active in tapping. "As well as spinning off divisions, corporates are also spinning out good management teams," Adelis's Steffansson says. "We will often augment entrepreneurial management teams with an addition, either a C-suite executive or a hands-on board member, who have developed their skills at a corporate."

Across the mid-market, where firms have historically grown fund size and moved into the large-cap space, there have been a number of managers happy to remain firmly in the mid-market, but grow manageably. "There are ambitious groups looking to grow fund size significantly, but also several that are happy to increase by 20% and continue operating in the sweet spot they've been successful in," Campbell Lutyens' Hutton says. "For LPs, this offers the opportunity to get pan-Nordic exposure in the classic mid-market space. Growing fund size to €500m and above allows, for example, a US state pension to commit capital of the size they need to, and opens up a broader investor base for mid-market GPs."

Boots on the ground

The boon for mid-market fundraising is in part a consequence of the benefits that local managers have by virtue of being on the ground in the region, able to build networks among management and advisory communities, and spending more time sourcing deals. "Entrepreneurs and managers that we work with like the fact that the senior people they meet are local, speak the language and aren't sitting in London," Adelis's Stefansson says. "They are looking for a partner to grow their business, and will look for chemistry, not just attractive pricing. They will definitely be making reference calls about potential buyers."

Recognising that Nordic mid-market businesses represent a significant opportunity set, LPs have been actively searching out local managers who can offer deeper access.

LPs are actively looking for [Nordic] mid-market exposure, particularly European LPs who have been exposed to the Nordics for some time" – Adalbjörn Stefansson, Adelis Equity Partners

GPs in the mid-market space have been decisive in deploying this influx of capital. Unquote Data logged a record year in the €25-250m EV buyout space in 2017, with €5.4bn in aggregate EV across 75 deals. The first three quarters of 2018 have continued to build on this momentum, with €4.48bn deployed across 65 buyout deals in this size band. Should this pace continue, 2018 looks on course to approach €6bn in aggregate deal value in the mid-market, significantly surpassing the record year in 2017.

This ramp up in activity in the mid-market is mirrored in the Nordic region's buyout numbers across the size spectrum, with 2018 already logging €23.58bn in EV across 104 deals to the end of Q3, according to Unquote Data. This marks a 55% increase in value on 2017, and the second highest annual figure on record, approaching the €28.78bn in EV logged in 2006. With three months of the year to go, 2018 could challenge the previous high watermark of deal activity set 12 years ago.

With both fundraising and deal numbers on course to break records in 2018 and a quarter of the year still to go, the Nordic private equity market looks to be in rude health.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds