Articles by Gareth Morgan

UK Fundraising Report: Weathering the Brexit storm

Latest Unquote UK Fundraising report, published in association with Aztec Group, is now available to download

Secondaries in Private Equity

Unquote analysis of the secondaries market is now available for download

UK Fundraising Report 2018

Latest edition of the UK Fundraising Report is now available to download for Unquote subscribers

SBCERA set to increase annual PE allocation

Recommendation will be presented to board of retirement for approval in its January meeting

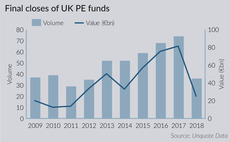

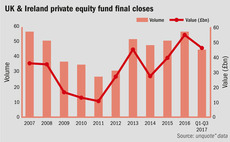

Brexit puts the brakes on UK fundraising

Country records its sharpest decline since the turn of the century in 2018, with anxiety around Brexit chief among investors' concerns

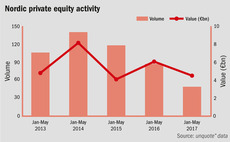

Mega-funds ignite Nordic nations

Region's PE fund managers raised the highest annual aggregate commitments on record in the first three quarters of the year alone

Nordic Fundraising Report 2018

Nordic private equity funds have raised a record amount of money for a calendar year

Value4Capital acquires Kom-Eko from Royalton

Capital was deployed from V4C Poland Plus Fund alongside participation from co-investors

Inflexion takes minority stake in European LifeCare Group

Investment is drawn from the £250m vehicle Inflexion Enterprise Fund IV, which closed in 2016

LP Profile: Allianz Capital Partners

Co-head of PE Michael Lindauer speaks to Unquote about the firm's history and approach to investment

ICG approaches first close for seventh European fund

ICG Europe VI held a final close on тЌ3bn in July 2015 and was 60% invested as of September 2017

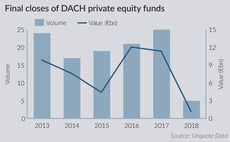

DACH Fundraising Report 2018

Private equity fundraising in the DACH region continued to build on strong momentum in 2017

DACH fundraising picks up steam after slow Q1

Funds holding final closes in Q2 have surpassed the total amount raised in the first quarter of the year, following a strong 2017

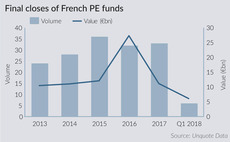

French fundraising on course for bumper year

Country has seen funds closing with a combined €6bn in commitments in Q1, more than half the total seen in 2017 as a whole

US pension fund seeks manager for $120m mandate

City of Fresno Retirement Systems, a $3bn pension fund, will invest $120m over three to four years

Nystrs searching for PE consultant

$115bn public pension fund has active private equity commitments of $19.5bn with 92 sponsors

CalSTRS looks to widen co-investment and direct investing

US LP, worth $224.8bn, is consulting on setting up direct investment capabilities

Lacera begins search for secondaries adviser

US pension fund looks to rebalance its PE portfolio by selling "dozens" of LP stakes

Crestline approaches final close of Portfolio Financing Fund

Texas-based GP is aiming to secure up to $500m in a February close for its debut fund

UK fundraising continues apace in 2017

Final closes in the first three quarters of the year show the UK is on track to surpass the post-crisis fundraising peak set in 2016

H1 fundraising reaches second-highest level on record

Last three semesters represent a significant increase on the total sums raised for final closes, compared with historical levels

HarbourVest closes co-investment fund on $1.75bn hard-cap

GP increases original hard-cap for fourth co-investment offering due to LP demand

Apex Ventures holds €10m first close six months into fundraise

Apex One will make early-stage investments in technology companies across Europe

Nordic fundraising market remains buoyant despite dealflow dip

In the first part of our 2017 Nordic Fundraising Report, unquote" examines statistics for the local market across 2013-2017