"Pass-the-parcel" deals surge in Nordic region as PE matures

With primary buyouts from private vendors and corporate carve-outs on the wane so far this year, secondary buyouts are accounting for a significant chunk of deal activity in the region. Greg Gille reports

Following a spectacular uptick in 2018, it is unlikely that Nordic buyout activity will reach the same dizzying heights this year with just one quarter remaining. Nevertheless, with 90 deals worth an aggregate €14.3bn recorded for 2019 at the time of writing, investors have certainly remained busy targeting assets in the Nordic countries.

But not all sources of dealflow have held up similarly. Secondary buyouts have remained very consistent in absolute terms around the 30-deal mark for most of the 2010s. With 29 such deals already recorded by Unquote in 2019, and with a traditionally busy Q4 still to unfold, it looks very likely that this number will rise and establish an all-time record – Unquote has never recorded more than 32 SBOs in a single year in the region since records began in 1992.

On the other hand, corporate carve-outs and, more importantly, deals sourced from private vendors have been much more inconsistent. The former in particular can see their numbers double from one year to the next, and with only 13 deals recorded so far in 2019, the signs are pointing to a lean year this time around. Dealflow coming from family and private vendors spiked significantly in 2017-20, and it would take another 30 such transactions completing before year-end (on top of the 49 recorded so far) for 2019 to maintain those levels.

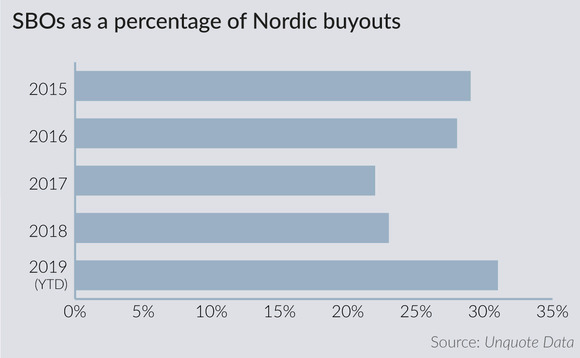

With such statistical dynamics at play, it is not surprising to see that SBOs are accounting for 31% of all Nordic dealflow this year, a significant jump on the c23% seen in both 2017 and 2018. That market share is even exceeding the 29% seen in 2015, just before primary dealflow took off properly for a three-year period. SBOs exceeded that level on only one occasion since Unquote records began, in 2013 (35% of all buyouts). In any case, 2019’s percentage is well in excess of the 23% average seen over the 2008-2018 decade.

Climbing through the ranks

The proportion of SBOs is also now higher in the Nordic region than it is across Europe as a whole – so far this year, 27% of all buyouts across the continent have been sourced from other private equity houses. Scandinavia is now edging closer to the traditional hotspot of SBO activity, France, where "pass-the-parcel" deals regularly account for more than 40% of all buyouts in volume terms. By comparison, secondary deals only account for 19% of all transactions in the DACH region so far this year. Even in the very mature UK market, the proportion is currently standing at just under a quarter of all deals (24%).

The trends that traditionally drive secondary buyout prominence could all have a bearing when it comes to the Nordic private equity market in 2019. First of all, the local industry matured at a rapid pace in the 2010s, with buyout activity ramping up noticeably from 2014 onwards – private equity houses are currently sitting on a large portfolio of Nordic assets that require exiting. At the same time, Nordic fundraising has been strong across the 2014-2018 period – and international GPs have been eager to tap into local opportunities – meaning that the growing supply has been met by rising demand.

This does not explain why primary sources of dealflow have proven less plentiful and/or attractive, though. SBOs tend to be viewed as more defensive on the buy-side, where the "pre-screened" nature of the assets, the usual rapidity of deal execution and the cultural affinity between buyer and seller can all outweigh the oft-cited (but debatable) lower expected returns. In a Nordic market where concerns around escalating pricing are particularly high, and given that private equity players Europe-wide are now factoring in a looming downturn in their investment decisions, the "safety first" consideration cannot be discounted to explain this trend.

Investment activity in Q4 and over the first half of next year should start offering hints as to whether the market has indeed shifted due to maturity and risk appetite, or if this SBO surge will remain a statistical anomaly in line with that seen in 2012-2013.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds