Nordic M&A to withstand mounting macro and geopolitical pressures - panel

The Nordic M&A market will remain resilient in the face of macroeconomic and geopolitical issues, dealmakers said at the Swedish Chamber of Commerce M&A event in London last Thursday (10th March).

With mounting challenges and concerns due to rising inflation, energy prices, production costs, and the fallout from Russia's attack on Ukraine, there has been a shift in the Nordic deal environment, with the IPO window now all but closed, the speakers acknowledged.

The attack on Ukraine has raised fears over the security of Russia's other neighbouring countries, resulting in questions whether there will be a risk premium on some Nordic assets due to their geographical position. This is a particular concern in terms of assets in Finland, which has a 1,300-kilometre land border with Russia.

While people should not be afraid of investing in Finland or the rest of the region due to Russia's proximity, regrettably many will have concerns, and this will impact the deal environment to some extent, a banker conceded.

The Riverside Company's planned dual-track exit of portfolio business Reima, a Finnish children's wear brand, is an example of a process negatively impacted by its exposure to Russia.

However, the underlying sentiment is positive, with the speakers agreeing there will continue to be more investment opportunities, albeit they may look somewhat different than over the last 18 months. More restructurings and take-privates, for example, are likely to be on the cards, while sectors that have not been in focus for several years, such as oil and gas, could attract renewed interest.

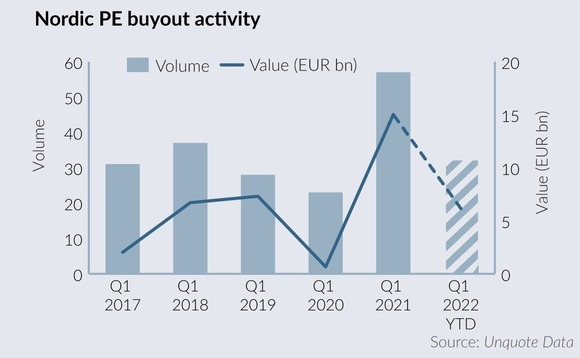

Yet, it seems unlikely the region will reach the same levels of private equity buyout and exit activity in 1Q22 as those seen a year ago. In 1Q22 to-date, there have been 32 Nordic sponsor buyouts at a total value of EUR 6.14bn, while for the full 1Q21 there were 57 buyouts for a hefty EUR 15bn, according to Unquote Data. In terms of sponsor exits, there have been 22 deals totaling EUR 1.4bn in 1Q22 to-date, while the full 1Q21 saw 37 at EUR 8.8bn.

With valuations decreasing over recent months, there is a "huge opportunity" for both private market acquisitions and sponsor-backed take-privates. Despite the "discounted" valuations, there are some great investments to be made, a PE speaker said. Take-privates are far easier to execute in the Nordics compared to the UK, for example, thanks to the region's less complex regulatory rules, another PE executive noted.

There will, however, be more miss-pricings, the first PE executive said. Valuations are difficult to assess as, due to the pandemic and subsequent turmoil, companies have not operated in a "normal" environment for the past few years, a third PE executive said.

Wider auction processes are becoming fewer, with more sellers, including PEs, engaging in bilateral discussions, or perhaps inviting a couple of parties to look at an asset, one of the PE executives and a corporate executive said, adding that broader processes carry more risk.

However, there are some notable, high-profile sale processes underway that are expected to have wider participation, including Cinven-backed Envirotainer, a Swedish temperature-controlled air cargo containers provider, and EQT Partners's expected minority stake sale of its Sweden-based long-haul fibre and datacentre asset GlobalConnect Carrier.

Increasing US investor interest

Nordic assets, such as in the health tech life sciences sectors, are starting to attract more US investors as valuations in the region are lower than in North America and there is less competition for targets, two venture capital executives said. It is positive that the region's profile is rising among US investors, one of them added. However, the region is yet to see big US pharma companies paying much attention to Nordic targets despite the quality being on par with those across the pond, one of them said.

Last month, Medable, a California, US-based decentralised clinical trials platform backed by investors including Blackstone Growth, announced it had acquired Omhu, a Danish digital health tech company, from LEO Innovation Lab.

IPO prep behind scenes

While IPOs are not going ahead for now, advisers are still urging clients planning a listing to continue preparation work in the background and be ready to proceed when the situation changes, a banker said. However, most cases previously intended as pure IPO processes, will now opt to do an M&A check in the meanwhile, the same banker said, with another PE executive interjecting that thanks to this, acquisition opportunities are increasing.

Companies that have postponed IPOs include Doktor.se, a Swedish telehealth company trading as Doktorse International, which originally aimed for a 1Q22 listing in Stockholm and had retained Morgan Stanley and Carnegie as IPO advisers. The company has no specific date for its IPO, CEO Martin Lindman told this news service, and was more recently quoted in a local press report that it could wait until next year.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds