Benelux Unquote

Carlyle buys stake in Mak-System

Belgium-based blood chain management software company draws investment from two Carlyle vehicles

Oakley sells stake in AtHome to Mayfair

Listed vehicle Oakley Capital Investments reports proceeds of £15m from the sale

Main Capital Partners exits Onguard to trade

GP stands to make a double-digit money multiple from the sale of the credit software company to Visma

CapitalT holds first close for debut fund

VC firm was founded by Janneke Niessen and Eva de Mol, and will target €40m for its first vehicle

KKR-backed Gamma takes stake in Univercells subsidiary

KKR's $50m investment in Univercells will be drawn from its Health Care Strategic Growth Fund

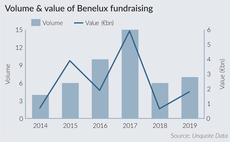

2020 Outlook: Benelux dealflow breaks records as fundraising recovers

While often out of the European private equity limelight on the deal-making side, the Benelux region quietly posted an excellent 2019

Vesalius, Swisscanto in €19m series-B for OncoDNA

Fresh capital will be used for international growth and software development acceleration

Main Capital sells TPSC to PE-backed Symplr

Sale ends a six-year holding period for the GP, which bought TPSC via its €40m Main Capital III fund

Parcom Capital acquires Euramax Coated Products

US-based parent company Omnimax International sold the business to the Netherlands-based GP

Shoe Investments, Knight Venture in €2.75m series-A for Dealroom

Funding will support Dealroom's continued international expansion in Europe and beyond

Cerberus sells Covis Pharma to Apollo

Sale ends a nine-year holding period for the GP, which built Covis through a series of acquisitions

M80 acquires Spantech

M80 Capital I looks to provide equity tickets of тЌ10-40m to companies in Benelux and France

VCs in €20m series-B for PDCLine

In 2016, Belgian VC Meusinvest, Spinventure and several business angels invested €4m in the company

Ergon Capital Partners to back CompaNanny

Belgian GP plans to back the company, according to a document by the Dutch competition authority

OxGreenfield backs Bavak Beveiligingsgroep

Founded in 2019, OxGreenfield backs Dutch companies generating a turnover of up to €50m

3i creates new bioprocessing platform with Cellon acquisition

GP is currently looking for a CEO to sit across the divisions of the new platfom

Vendis appoints Riisberg as senior adviser in Nordic region

Christian Riisberg was previously founding partner of Alipes and a board member for various companies

IK to acquire Acture Groep

IK will buy a majority stake, investing via its €550m IK Small Cap II fund, which closed in Q1 2018

SET Ventures Raises Fund closes third fund on €100m

Dutch VC closes the fund, launched in Q1 2019 and focusing on energy transition

GHO Capital buys Ardena from Mentha

Mentha created Ardena by merging three portfolio companies in 2017 and conducting bolt-ons

Bencis to back EMC Group SBO

Holland Capital will end its 10-year ownership in the Dutch medical staffing specialist

Consortium in €36m series-B for NorthSea Therapeutics

US-based VCs VenBio and Sofinnova Investments back the business for the first time

SmartFin closes sophomore fund on €240m

Belgian early-stage and growth fund will provide €500,000-12m equity tickets

Slingshot, Shoe back Swishfund

Fresh capital will help Swishfund to develop its software and expand its client base