Unquote

Multiples Heatmap: average entry multiple hits 10.5x as dealflow recovers

The UK and Ireland was the hottest region for multiples in Q3, also seeing the largest increase in valuations of any region

Aberdeen secondaries fund on track for early 2021 final close

Secondary Opportunities Fund IV has raised more than half of its $500m target

Covid-19, oversubscribed funds fuel interest in early secondaries

Early secondaries are tipped to become more plentiful in the coming months, but market observers urge caution to mitigate potential pitfalls

ICG launches new secondaries fund ahead of schedule

Strategic Equity IV is the firm's fourth vehicle dedicated to GP-led secondaries

Unquote Private Equity Podcast: LP perspectives

Elias Korosis from Hermes GPE joins the Podcast to discuss co-investments, fund financing and the outlook for 2021

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

EQT Growth's bet on maturing European startups

New growth investor plans to announce at least one deal by the end of the year, says partner Carolina Brochado

TA Associates appoints new head of IR

Andrew Harris served in investor-focused roles at Advent International for more than eight years

Värde Dislocation Fund closes on $1.6bn

Fund has a global mandate to pursue a mispriced, stressed and distressed credit

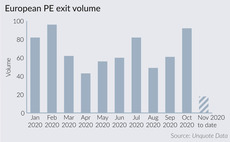

Private equity ramps up divestment efforts

Exit activity jumped by 50% in October, back to pre-pandemic levels, according to Unquote Data

Buyout rankings: who has invested most across Europe since April?

EQT, Ardian and KKR remained very active and struck sizeable deals amid the coronavirus turmoil

Fountain Healthcare Partners III closes on €125m

Fund is dedicated to investments across the life sciences sector, with a focus on therapeutics and medical devices

Mutares carves out two units from Gea Group

Deal includes the companies' sites located in France and the Netherlands, with a total of 230 employees

MCH sets up continuation fund to retain Europastry stake – report

Spanish GP rules out an exit of the patisserie business via either a stake sale or an IPO

Preparing for the turnarounds wave

The much-anticipated wave of distressed opportunities has failed to materialise so far, but market participants are still readying for an uptick

Sponsor-lender relationship faces stiff Covid-19 test

GPs' relationships with their existing banks and debt funds will remain key to managing the ongoing consequences of the crisis

Download the November 2020 issue of Unquote

The latest issue of the Unquote magazine is now available to our subscribers

Claret Capital takes over Harbert European Growth Capital

Claret secures the GP and its funds, and hires the entire HEGC investment team

Secondaries update: Unigestion's David Swanson

Secondaries activity is recovering from the initial coronavirus-related shock, with good prospects for GP-led secondaries deals

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Ardian bolsters buyout team with five new MDs

Scarlett Omar Broca and Heiko Geissler join in Paris and Frankfurt, respectively

Blackstone Core Equity Partners II closes on $8bn

BCEP II follows a long-hold private equity strategy, with an investment period of 15 years

Digital doctors here to stay as telemedicine deals surge

Rise in demand for telemedicine т and promising returns for investors that have been targeting the space т looks set to continue

Pantheon appoints Cashion as co-investment partner

Matt Cashion joined Pantheon's New York office earlier in October