Private equity ramps up divestment efforts

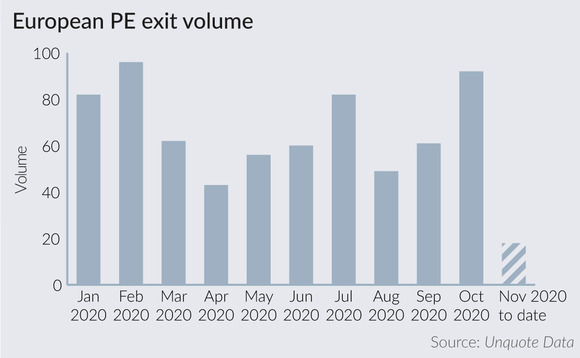

Following another period of lacklustre exit activity in Q3, even as deployment was picking up, October saw a notable spike in divestments by PE players across Europe.

GPs announced full or partial exits from 92 investments in October alone, according to Unquote Data. This is a 50% uptick on the September figure, a whopping 113% increase on the low point of 43 exits reached in April, and compares favourably to the 88 exits recorded on average per month between January 2018 and February 2020.

Furthermore, the October 2020 figure exceeds that recorded in the same month in both 2019 and 2018.

With 14 exits already recorded in the first week of November alone – and bearing in mind that secondary research usually continues boosting these numbers for some time after any given month ends – the momentum shows signs of continuing.

The UK has been home to the lion's share of divestments since July (22% of all European exits), closely followed by France (20%) and Germany a distant third on 12.5%.

The exit routes explored by GPs have also undergone some slight but notable shifts. Looking at Q3, trade sales accounted for 45% of all exits, while SBOs made up 23% of the total – the latter is somewhat lower than the 26% seen over the 2018-2019 period. Meanwhile, the statistics highlight how managers are pushed to be increasingly creative to realise value in the current environment, with partial sales making up 10% of Q3 exits, against a two-year average of 6%.

The picture has started to change again recently when it comes to secondary buyouts, though, with such deals accounting for 28% of divestments since the beginning of October.

Indeed, recent days have seen a slew of deals transacted between GPs, including ECI selling MPM to 3i for £170m; Bregal acquiring STP from Hg; Ace buying Astorg's Aries Alliance; and PAI Partners acquiring Addo Food Group from LDC and Winterbotham Darby from Equistone, among others.

It is worth bearing in mind, however, that these figures will reflect a buffer between deals being signed and ultimately being announced. They are therefore likely to correlate with a spate of processes progressing in September, just as coronavirus containment measures were at their most relaxed in a number of European markets.

In other words, it remains to be seen how new lockdowns to deal with the second wave of the pandemic, and the general uncertainty around trading prospects for a number of sectors, will be reflected in the December and January statistics.

Selection of PE-owned assets currently up for sale

| Asset | Sponsor | Country | Latest Mergermarket intel |

| Thinkproject | TA Associates | Germany | TA Associates has launched the sale of Thinkproject with indicative bids due to be collected by 9 November, Mergermarket reported on 9 November. |

| Compagnie Stephanoise de Sante | Eurazeo | France | Eurazeo is said to have appointed Rothschild to advise on the sale of its majority stake in French hospitals group Compagnie Stephanoise de Sante (C2S Group), Capital Finance reported on 5 November. |

| Infra Group | Andera Partners | Belgium | Andera Partners is understood to have appointed financial adviser Amala Partners to conduct the potential sale of Infra Group, a Belgium-based specialist in controlled drilling for water, gas, electricity, sewerage, industrial piping, telecoms and cable television, L'Agefi reported on 5 November. |

| Iberchem | Eurazeo | Spain | Eurazeo has mandated BNP Paribas for the sale of Iberchem, a Spain-based perfumes and fragrances company, Expansion reported on 2 November. The company could be valued at around €800m. |

| Eolo | Searchlight | Italy | Searchlight has attracted industrial and private equity interest for its 49% stake in Eolo, the Italian fixed wireless and broadband company, according to a report in Milano Finanza on 4 November. Eolo could be valued at €1bn. |

| Sweaty Betty | L Catterton | UK | Sweaty Betty, a UK-based leisurewear retailer, has engaged Goldman Sachs to explore possible investment from the private equity sector, The Times reported on 2 November. A valuation of approximately £250m is anticipated. |

| Elysium Healthcare | BC Partners* | UK | Elysium Healthcare, a UK-based mental health service and special schools operator, is estimated to fetch approximately £900m if sold, the Financial Times reported on 2 November. BC is understood to have hired JP Morgan to manage a sale process. * |

| Alliance Etiquettes | Activa Capital | France | L'Agefi reported on 5 November that private equity house Activa Capital has appointed Amala Partners to assist on the potential sale of French labels printing group Alliance Etiquettes. |

| 7days | Silverfleet | Germany | Mergermarket reported on 7 November that the auction for Silverfleet-backed 7days, a German medical workwear company, has admitted Chequers Capital, FSN Capital Partners, Gilde Buy Out Partners, Investcorp and Paragon Partners into the final round of the process. |

Source: Mergermarket

* BC Partners owns a minority stake in Acuris, the publisher of Unquote

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds