Q&A: Spain's evasive buyout market

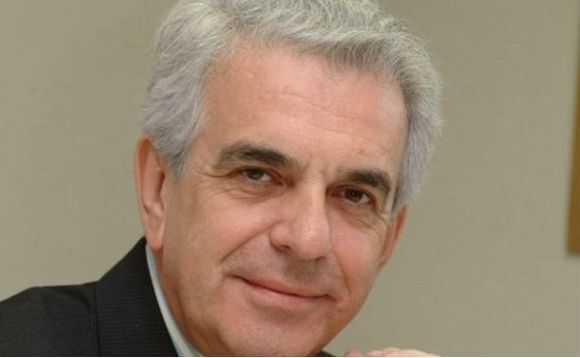

The Spanish buyout market has had to jump over many hurdles these past couple of years. Francinia Protti-Alvarez speaks to José Angel Sarasa, president and CEO at Baring Private Equity Partners España, on its present state and future challenges.

What were the features that characterised the Spanish buyout market over the past year?

What differentiated the Spanish buyout market was the size of the transactions. While in 2009 the level of transactions carried out in the mid-market was steady, no large transactions were completed, mostly because bank financing is more difficult to come by than in other countries. The activity of foreign private equity houses therefore fell significantly as most are involved in these larger transactions. 2010 looks to be more or less the same, which leads me to believe that they will remain absent from the market. However, with reference to the mid-market, there are clear signs of recovery with both deal quantity and quality on the rise.

What is likely to drive activity?

Sectors whose activity will begin to pick up include the services and industrials spaces, especially those companies with mid-level technology that can effectively compete in developed markets. Companies focused on foreign markets and above all some of the Latin American markets such as Brazil, Mexico and Colombia, should also fare well, along with companies in any sector that is well-positioned for exporting.

And about the other side of the coin: exits?

There's an obvious shortage of exit opportunities, with no easing likely in the short term given the lack of available financing for secondary buyouts or for strategic buyers. There may be the potential for some divestments to take place because, among other things, the stock market is becoming more active and strategic investors are beginning to take up positions again. Yet the stock market has also clearly not functioned as well as it should for everyone. We'll just have to wait and see.

What are the main hurdles visible on the horizon?

The private equity industry in Spain can expect to face a difficult time raising funds, with internal investors focused on their own difficulties. But we are bullish about activity: dealflow will continue to improve, albeit slowly, especially in the mid-market. We have confidence in improvements coming in terms of financing for exisiting investments, though we are less optimistic about the outlook for leverage for new deals. Indeed, we are pessimistic in respect to large transactions as the most active lenders will be Spanish banks that focus on the €10-40m range.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds