Contrasting fortunes for Southern Europe

Southern Europe has experienced some of the toughest trials of the financial crisis, with its countries experiencing bank collapses, credit downgrades and dire predictions for their economies. Despite an overall gloomy economic outlook across the region, private equity has seen mixed levels of activity. John Bakie gives an overview

The countries bordering the Mediterranean have often been seen as the ‘sick man of Europe', struggling to live up to the high levels of growth experienced in more northerly nations during the boom years in the middle of the decade. This came to a head earlier this year, with Greece's debt crisis threatening to drag down the whole Eurozone, while Spain saw several of its regional Cajas fail a recent EU-wide stress test.

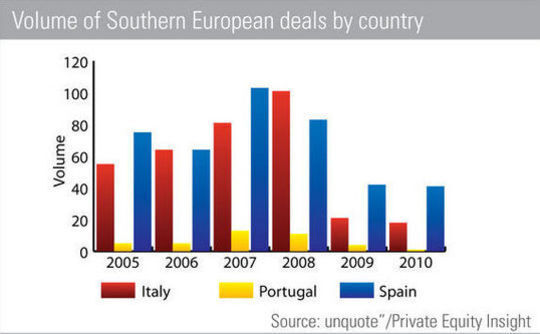

However, Spain's private equity industry has remained remarkably resilient to the financial turmoil, and appears to be making a rapid recovery this year. So far this year, Spain has seen 41 private equity-backed investments, just one fewer than in the whole of 2009. With a number of major deals also thought to be in the pipeline, Spain is rapidly bouncing back to pre-crisis levels of activity.

Spain was also fortunate to suffer a less dramatic decline in private equity investment following the collapse of Lehman Brothers. Volume fell by just over 50%, from 83 deals in 2008 to 42 last year. This compares favourably with Italy, where deal activity plummeted 80%, from 101 to 21 over the same period.

Italy has also failed to see a strong recovery in its fortunes, with just 18 deals so far this year. This comes despite the Italian economy not suffering the same fall in GDP as many other European countries following the credit crunch. While the country's banks were not as burdened with bad debts as those in other parts of Europe, they seem to have become even more cautious following the crisis, and buyouts have been hit particularly hard.

Meanwhile, Portugal continues to see limited activity, with just one deal recorded so far in 2010, compared to four last year. The country rarely sees significant activity, but the boom of 2007 brought 13 deals, and interest in Portugal remained strong into 2008 with 11 investments.

So, Southern Europe appears to be a place of contrasts. While the countries of the Mediterranean are often linked together, they fared very differently during the financial crisis, and the future of private equity in the region is likely to remain inconsistent for years to come.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds