Advent International

Advent-backed Zentiva acquires Alvogen

Transaction is expected to close in the first quarter of 2020, subject to customary approvals

Ohio pension to launch private markets co-investment programme

Co-investment programme will potentially invest in European private equity, but details are still to be determined

Arx buys TES Vsetin from Advent

Existing management team will lead the company's future growth and development

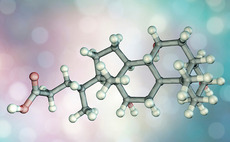

Advent buys Industria Chimica Emiliana

GP intends to further strengthen the company's market position and boost its international expansion

Advent raises $2bn for tech fund

Fundraise comes shortly after the $17.5bn final close of the GP's flagship product, GPE IX

Advent et al. bid for ThyssenKrupp elevators division

Carlyle, CVC, KKR, and Blackstone Group are also reported to be interested in the unit

Advisory firm recommends Advent's £3.9bn offer for Cobham

BlackRock, M&G and Legal & General each hold more than 2% of shares in the aerospace company

PE-backed Nets offloads division to Mastercard for €2.85bn

Acquisition comprises Nets' clearing and instant payment services, and e-billing solutions

Advent International agrees £4bn take-private for Cobham

Proposed share price represents a 50.3% premium on the average value across the last three months

Advent backs Spanish dental group Vitaldent

GP intends to accelerate the company's organic growth and strengthen its market position

Advent hits $17.5bn hard-cap for ninth fund

Close puts it just inside the top 10 for largest Europe-focused buyout funds ever

Oakley Capital carves out Ekon from Advent-backed Unit4

Equity for the deal will be drawn from Oakley Capital Private Equity III, which closed on €800m

Ohio pension invests $40m in PE funds

US pension has targeted $80m for new private markets commitments through the rest of 2019

Bridgepoint kicks off Primonial sale

Bridgepoint reportedly hired Rothschild and JP Morgan to conduct the sale in January

Nexi to float on Italian stock exchange in April

Placement includes existing shares as well as new shares issued via a €600-700m capital increase

Advent International set to secure US LP commitments

Advent International GPE IX has a target between $15-17bn and plans to hold a final close in mid-2019

Advent acquires Evonik's methacrylates business for €3bn

GSO offered bidders a unitranche of €1.5bn and Barclays offered an all-loan structure of €1.25bn

Carlyle's Comdata carves out PayCare from PE-backed Nexi

Deal follows the sale of Oasi, purchased by FSI's Cedacri from Nexi for €151m in January

Minnesota State Board set to commit $550m to PE

LP is set to commit $550m to four private equity funds, according to its latest meeting minutes

Advent hires former TPG partner Taylor as head of tech

Taylor previously co-founded Symphony Technology Group and was a consultant at Bain & Company

FSI's Cedacri carves out Oasi from PE-backed Nexi for €151m

Cedacri will finance the acquisition with a debt package provided by a pool of 14 banks

Advent's Circet bolts on KN Group

Transaction for the engineering services company comes 10 months after the GP acquired Circet

Advent exits WSiP to Central Group

Under Advent, the company evolved from being a textbook publisher to an educational services provider

Rhône acquires 45% stake in Maxam from Advent

Deal closes seven-year holding period for Advent, during which the company expanded internationally