CapVest Equity Partners

Polaris sponsor CapVest weighs sale of children's services giant via PwC

Regulatory scrutiny on childrenтs services and fostering sector has stepped up since a 2021 CMA report

PE roll-up strategies face regulatory heat with focus on consumer industries

With longer holding periods facilitating more bolt-ons, regulators including the UK's CMA are intervening

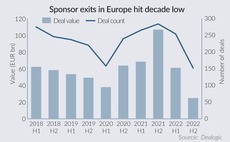

Going, going, not gone: PE auctions bid for relevance amid risk-off environment

With a debt financing drought and macro woes denting exits, GPs are adapting the traditional M&A auction in favour of more flexible bilateral negotiations to get deals across the line

H2 Equity's Optegra sale advances to second round

UK-based ophthalmology business has received NBOs implying an EBITDA multiple of more than 15x

CapVest, Duke Street in second round for Evergreen Garden Care

Vendor Exponent is expected to collect final offers at the beginning of December

CapVest gears up for launch of CapVest V

GP backs mid-market companies in essential goods and services; it sold Valeo Foods to Bain for тЌ1.7bn in May 2021

Bain Capital buys Valeo from CapVest

Bain intends to further boost the company's growth both organically and through acquisitions

CapVest sells Eight Fifty to Sofina Foods

Combined group is expected to employ 13,000 staff across 44 sites and generate $6bn in annual revenues

NVM sells It's All Good to CapVest-backed Valeo Foods

IAG is the 15th food business to be acquired by Valeo Foods since it was founded in 2010

PE-backed Eight Fifty Food Group buys M&M Walshe

Post-acquisition, Eight Fifty's revenues are expected to increase to approximately ТЃ1.4bn.

Capvis-backed Variosystems buys Solve Engineering

Add-on of Swiss market peer is the first in Capvis's investment period and in the company's history

The Deals Pipeline

A fortnightly highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Bowmark hires two, including new partner

Both Mani and McRae have joined from the small-cap investment team at CapVest, where Mani was head

Capvest's Valeo acquires Blackstone-backed Tangerine

Reported deal for the confectionery firm comes eight months after the acquirer made a тЌ100m bolt-on

CapVest targets €1bn for fourth fund

Vehicle is a significant increase on CapVest Equity Partners III, which closed on тЌ482m

CapVest's Karro bolts on TS Bloor & Sons

Karro expects to consolidate its market position in the UK food industry with this acquisition

CapVest sells Scandza to management

Buyers will acquire 60% of Scandza from CapVest, according to a local media report

CapVest's Valeo buys Raisio's confectionery brands for €100m

Acquisition of Big Bear, Nimbus and Candy Plus is the ninth bolt-on made by the group

Sun sells Nextpharma to Capvest

Sun says it strengthened senior management and optimised the manufacturing processes during its tenure

Endless sells Karro to CapVest

Transaction reportedly values the meat processing business around the ТЃ180m mark

Nordic IPO health check – how have 2014's listings fared?

With the Nordic private equity market continuing to list assets, how have 2014's IPOs performed?

PE-backed RenoNorden raises NOK 309m in IPO

Sanitation company listed at NOK 47 a share and closed first day at NOK 45.80

Accent and CapVest launch NOK 1.4bn IPO of RenoNorden

Listing is expected to be completed by mid-December

Capvest buys Scandza

Capvest Equity Partners has completed the management buyout of Nordic food and beverage business Scandza.