CIC

Investindustrial launches €600m China-Italy Fund

CIICF intends to support the expansion and development of Italian companies across the Chinese market

Andera acquires two services companies from Salini

Deal is GP's 13th investment from €165m vehicle Cabestan Capital II, which closed in 2016

Eurazeo holds €400m first close for France-China Cooperation Fund

Fund targets European companies with expansion and growth plans in the Chinese market

CIC Private Debt closes CIC Debt Fund 3 on €530m

CIC is also fundraising for CIC Mezzanine & Unitranche 5, which launched in September and held a first closing on €150m

CIC backs Mega Gossau

CIC Capital has acquired a minority stake with the management team retaining a majority

CIC and BNP Paribas pursue China strategy with Eurazeo

Eurazeo will manage a fund dedicated to European companies seeking to expand in China

CIC et al. in £10m round for GeoSpock

Round for geolocation data business GeoSpock brings total capital raised to ТЃ19.25m

Weinberg Capital-backed Climater acquires Aditec

Weinberg Capital Parners had acquired a majority stake in Climater in 2011

CIC and Octopus in £13.7m round for Origami Energy

VCs previously took part in a ТЃ3.5m seed round for the UK-based software-as-a-service firm

VC-backed Abcodia raises £5.25m

Funding round led by SEP and CIC, who join existing investors

CIC Mezzanine tops up third fund with extra €15m

French GP CIC Mezzanine is understood to have held a final close for its third fund on €180m, €15m more than the amount announced at the beginning of May.

CIC's head of PE sees opportunities in Europe

The challenging fundraising environment means it is a good time to target private markets, and Europe in particular, according to the head of China Investment Corporation's (CIC) private equity investment department.

3i looking to divest Labco and Civica

3i has initiated much anticipated exit processes for Labco and Civica, two acquisitions made in 2008, according to reports.

21 Centrale buys Cleor off Azulis

21 Centrale Partners has taken a majority stake in the management buyout of French jewellery retailer Cleor.

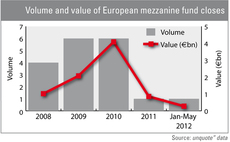

Are mezzanine funds making a comeback?

The launch of 123 Venture’s latest mezzanine fund, the €100m Trocadero Capital Transmission II, is the second mezz fund launch this year with CIC Mezzanine III. In parallel, the number of mezzanine funds reaching final close has declined from 6 in 2010...

China Sovereign fund European PE head quits

The European head of private equity at China Investment Corporation has resigned after only four months in office.

CIC Mezzanine holds €63m first close

CIC Mezzanine Gestion has held a €63m first close on its third mezzanine fund, three months after launch.

3i buys Etanco off IK

3i has acquired a majority stake in French building fasteners manufacturer Etanco from IK Investment Partners.

CIC LBO Partners et al. acquire AMS

CIC LBO Partners and CM-CIC Capital Privé have acquired French healthcare provider AMS from Capazanine for an undisclosed amount.

Techfund et al. invest €2.5m in Polyplus

Techfund Capital Europe several and several CIC investment arms have provided French biotech company Polyplus-transfection with €2.5m of funding.

Azulis Capital leads Brunel SBO

A private equity consortium led by Azulis Capital has acquired household cleaning products manufacturer Brunel from ING Parcom, Abénex Capital and CIC Investissement Nord.

Naxicap invests €1m in Xynergy

Naxicap has invested €1m in newly-created French healthfood company Xynergy.

Seventure and CM-CIC invest €4.2m in EffiCity

Seventure and CM-CIC Capital Privé have invested €4.2m in French estate agent EffiCity.

Call centre investments: Supporting the recovery

During the downturn, private equity firms invested defensively, particularly in the outsourced services sector. Now the economy is recovering, investors are looking to benefit from what is widely seen as a consolidating market. Mareen Goebel gives an...