Exclusive

Motive raises USD 2.54bn across Fund 2 and co-investment vehicles

GP's USD 1.8bn Fund 2 is 3.7x the size of its predecessor and expects to make 15-18 deals

August Equity to target GBP 400m in fundraise for upcoming sixth fund

Fundraising plans come following several exits from the GPтs 2016-vintage fourth fund

Scale Capital eyes EUR 70m-100m for new VC fund by year-end

Danish GP in talks with institutional investors after EUR 27m first close for Fund III in April

Siparex holds EUR 450m final close for ETI 5

Mid cap-focused fund is 60% larger than its 2017-vintage predecessor and has made four investments

Erhvervsinvest gears up for Fund V final close in 9-12 months

Danish GP held DKK 1bn first close for small-to-mid cap vehicle; targets hard cap of DKK 2bn

Superangel targets up to EUR 50m hard cap for second fund

Estonian VC firm seeks further institutional investors; SmartCap to make EUR 15m anchor commitment

Curiosity VC eyes EUR 75m fund close in 2023

Dutch investor has commitments from 55 LPs for fund launched last year

Unigestion holds EUR 900m final close for fifth secondaries fund

Fund is more than three times the size of its predecessor and is more than 50% committed

Algebris holds EUR 200m first close for debut Green Transition Fund

Fund has a EUR 400m target and is headed by three former executives from Italian utility company A2A

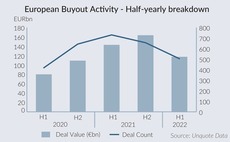

Deft deployment, creative exits drive PE agenda into H2 2022

Take-privates, bolt-on opportunities and demand for resilient healthcare and technology assets offer hope for challenging second half of the year

Capza launches SME decarbonisation fund with EUR 1.3bn target

Second vintage of the SME-focused strategy will aim to support its portfolio companies with decarbonisation

Earlybird holds Growth Opportunity V first close

Later-stage fund has a EUR 300m target and will mainly back existing Earlybird investments

INVL inches closer to second Growth Fund

Work on Fund II could start once INVL’s debut vehicle is 75%-80% deployed, following two to three more deals

Plural holds EUR 250m final close for debut early-stage fund

VC firm is led by technology founders Ian Hogarth, Khaled Heloui, Sten Tamkivi and Taavet Hinrikus

Acton Capital holds Fund VI first close, expands investment team

VC firm has hired Sophie Ahrens-Gruber in Munich and appointed Hannes Gruber as partner in Vancouver

VC Profile: Octopus backs pre-seed ecocystem with fresh fund

Fund is headed by Kirsten Connell and Maria Rotilu and has extended its hard cap to GBP 15m following a first close

Titanbay launches co-investment programme

Private markets platform plans to make 10-12 deals per year and has a live opportunity in Germany

Unigestion gears up for Climate Impact Fund

GP in initial discussions with existing investors for first climate-focused fund

Dunas Capital holds first close for debut impact fund

Vehicle plans to enter distribution partnership with private bank for its EUR 50m fundraise

Kiko Ventures launches GBP 375m cleantech investment platform

New evergreen VC investment platform is backed by London-listed investment firm IP Group

Record number of LPs to cut "new money" commitments – Rede Partners

Biannual LP sentiment survey also reveals that LPs are expecting a drop in distributions

Phoenix Court Group raises USD 500m for four VC strategies

London-headquartered VC is raising for its LocalGlobe, Latitude, Solar and Basecamp funds

GP Profile: Ergon hones in on long-term trends, ESG agenda

The European mid-market sponsor is eyeing growing and resilient businesses with its EUR 800m Fund V

LGT Capital closes first dedicated impact fund on USD 550m

Crown Impact will make co-investments, as well as primary and secondary fund investments