Exclusive

Alderwood Capital mulls significant stake sale in bid to kickstart PE fund

London-based GP was formed in 2020 and aims to raise a fund to take minority stakes in boutique asset managers

Buy now, realise later - sponsors go on spending spree amid exit lull

Mounting dry powder sees GPs turn to primary buyouts, P2Ps and carve-outs, although exit pressure remains

Unquote Private Equity Podcast: Growth equity's mounting momentum

Bregal Milestoneтs Cyrus Shey and HPE Growthтs Manfred Krikke discuss investing, operational support and what's next for the industry

Geneo to hold final close for mezzanine impact fund by year-end

Evergreen sponsor has set EUR 200m target for the fund, which will focus on European companies

Contrarian Ventures targets EUR 100m hard cap for new climate tech fund

Lithuanian VC aiming to attract funds-of-funds for second close planned for the next month

GP Profile: Tikehau's Aerofondo set for aerospace industry take-off after first deal from debut fund

Spanish aerospace strategy aims to attract total commitments of EUR 150m-EUR 200m, with strategic LPs already in place

GCA Altium consumer MD to join Clearwater

Christopher Jones is expected to head up a new consumer sector team at Clearwater

Kindred Capital heads for first close of third fund

Alongside fundraise, VC plans to make three more sector-agnostic investments from its second, EUR 100m fund

GP Profile: Greenpeak Partners on emerging manager fundraising and specialisation

Buy-and-build specialist looks for portfolio add-ons as it contemplates hitting the road for a new fund in 2023

Pinova expects final close for Fund 3 before year-end

DACH industrial technology and IT investor has set a EUR 250m target for the vehicle

Castik Capital gears up for third fund

European mid-market GP held a final close for its predecessor vehicle on EUR 1.25bn in 2019

SwanCap plans October first close for Fund VI

German GP has a EUR 350m target for co-investment vehicle, which will follow the strategy of 2019-vintage predecessor

GP Profile: MCP steps up DACH and international focus ahead of next fundraise

ESG and continued expansion of its international LP base also on the agenda, managing partner Inna Gehrt tells Unquote

Synova V holds first and final close on GBP 875m hard-cap

The fund has a GBP 250m pool earmarked for smaller deals and expects to make a handful of DACH and Nordics investments

Unigestion invests in Afinum-backed bakery chain Zeit für Brot

Majority owner Afinum will transfer its stake in the company from its 2017-vintage Fund 8 to its newest fund

Ambienta plans asset class expansion following EUR 1.55bn Fund IV close

Environmental investor set for first deals with new fund in 2023 as it assesses a foray into new asset classes and geographies, founder and managing partner Nino Tronchetti Provera tells Unquote

AM Ventures holds EUR 100m final close for debut fund

Industrial additive and 3D printing VC expects to make two to three deals this year

ACP holds EUR 90m first close for debut credit fund

Fund aims to bridge the lending gap for Central European lower mid-cap businesses, complementing existing bank lending

ECI sells Bionic to Omers reaping 4.8x

Following the sale of the UK-based SME price comparison platform, ECI will reinvest via ECI 10

VC Profile: Vektor Partners backs tech mobility transformation with new fund

VCтs debut fund has a EUR 175m hard-cap and aims to back startups with initial tickets of EUR 3m-EUR 5m

Cinven plays long game with financials fund in hunt for 3x returns

With a life of 15 years, the new vehicle has closed above target, with insurers making up about a quarter of its LP base

COI Partners launches DACH growth fund with EUR 120m target

GP's first institutional fund will invest on a 50:50 basis alongside the sponsor's own deal-by-deal vehicles

Optimism prevails as PEs expect step-up in deal-making – research

Third Bridge's Joshua Maxey speaks to Unquote about the findings of the Mid-market PE Forecast: 2022

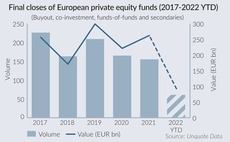

PE fundraising pipeline offers hope amidst slowdown in H1 2022

Final closes down by almost half so far this year, but a number of "mega-cap" vehicles in coming months could still bolster 2022 fundraising