Deft deployment, creative exits drive PE agenda into H2 2022

Following an almost too-good-to-be-true year in 2021, the outbreak of war in Ukraine and an impending recession are bringing a dose of realism to the world of private equity.

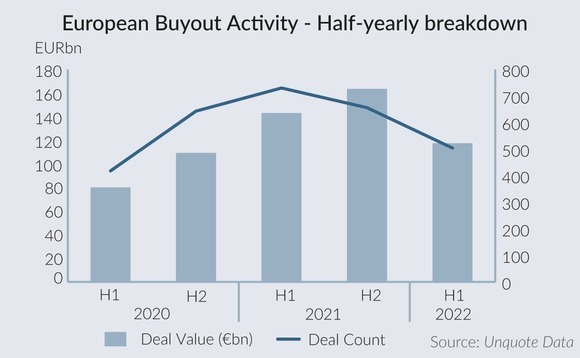

Sponsors in Europe have been taking stock of a tougher M&A climate that is already reflecting on deal activity, with private equity buyouts in the first half of 2022 dropping 31% in number of transactions and aggregate deal value down 17% on a year-on-year comparison, according to Unquote Data.

To put this in context, buyout value still stood in good stead in H1, with only 2021 and 2018 surpassing it. However, a much tougher second half could lie ahead.

"We are paying attention to our pace of deployment and creating a good mix of sectors and countries in our portfolio," Edouard Pillot, a managing partner in Astorg's Mid-Cap team, told Unquote. "Discipline is the name of the game: you have to be clear on what you will or won't do, and you need to stick to what has worked well for you, and where you have a competitive advantage."

The first changes in behaviour are expected to come from general partners (GPs), limited partners (LPs) and debt providers becoming increasingly selective, particularly in the large-cap space. A flight to quality, or at least a bifurcation in how good and bad assets are valued, is expected to set investors' mood in more uncertain times. Early casualties of this environment include the proposed sale of UK-based pharmacy chain Boots, with its parent Walgreens Boots Alliance deciding to retain ownership of the business as limited large-cap financing options impeded the process.

Some trends seen in the first months of this year could also point to clues about where the bright spots in M&A might be going forward. The demand for assets typically perceived as resilient to market cycles remained steady in H1 2022 versus the past year. Healthcare and technology buyouts made up 10% and 20% of deal volume respectively, figures that are broadly in line with the sector breakdown seen over the past year. Even with the technology sell-off in the public markets, software deals such as The Access Group, valued at GBP 9.2bn in a transaction with Hg, TA Associates and GIC, show that multiples continue to hold up for businesses considered most resilient.

Exits get creative

With a growing gap between buyer and seller valuation expectations, sponsors are looking for ways to secure liquidity for their LPs while retaining their best assets, or those that might need longer to show the result of value creation plans.

Continuation fund deals (also referred by the industry as GP-led secondary deals) are rising in prominence as a supplementary route to a typical dual-track process. While these structures are not new to the market, they are increasingly being viewed as a viable option.

"Our industry needs to be more creative when it comes to exiting businesses, especially in this environment," said Nikos Stathopoulos, partner and chairman of Europe at BC Partners, which transferred scientific publisher Springer Nature to a continuation fund in 2021. "People might transfer assets from one fund to another, and we might see people selling minority stakes to generate liquidity, while buying more time and selling the business a few years later, waiting for a better environment to develop before a full exit."

Advisers are increasingly adding GP-leds to their playbook of potential exit options, according to Christian Keller, managing director in the financial sponsors group at Houlihan Lokey. "When we pitch, we can provide the whole spectrum of options, and we have seen the use of GP-leds increasing over the last one or two years across the market," he said. "It is much more established now as interim step – continuation vehicles are just part of the discussion now. But it‘s not the ultimate solution to keep assets forever, and it doesn't make sense for every asset."

Recent examples include Equistone's decision to transfer France-based electricity distribution products and services provider Sicame to a continuation fund, as reported. These structures are not confined to single companies, however, with sponsors increasingly using them for a group of businesses with a common vertical. One such sponsor is Main Capital, which is planning a EUR 500m vehicle to house several of its health technology assets, as reported by Unquote.

Although conflicts are inherent in such deals, Ross Hamilton, member of management, private equity integrated at Partners Group, notes that the market can undergo a change of heart. "Ten years ago, SBOs were sometimes perceived less positively; is it just passing the parcel and how much value creation potential is left? These were valid questions at the time, however, SBO performance has generally been good. GP-led transactions allow continued value creation with high quality assets and much more flexibility around how transactions are structured."

Prevailing optimism

In spite of the uncertainty ahead, sponsors and their LPs do have reasons to be confident that the private equity market will weather the storm. Fundraising and the performance of the asset class held up throughout the coronavirus pandemic, and the nature of private equity means that a complete stop in deployment is not an option, with GPs and LPs alike seeking diversified exposure for each fund vintage.

Having experienced one of the longest bull markets on record, some private equity practitioners cannot help but take an optimistic view on opportunities to be found in a potential downturn. Sponsors seeking to snap up listed companies amidst public markets wobbles include CVC Capital Partners and Nordic Capital, which made a bid for Sweden-based vehicle glass repair and replacement provider Cary Group at the end of June. Astorg and Epiris's joint GBP 1.6bn bid for financial publication Euromoney is also still underway.

Market consolidation via buy-and-build strategies is also on the mind of many private equity firms as they look for opportunities amid uncertainty. "What we are excited about for our acquisitive portfolio is whether this environment throws up more opportunities. We can double down on that in the next few years if there are opportunities," Charles Rees, member of management, private equity technology at Partners Group, told Unquote.

"We're still looking for solid businesses, but if they are held by an owner who has a struggling portfolio with need for liquidity, it might unlock some transactions. This environment brings more realism," he added.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds