Exclusive

Equistone buys majority stake in Kusters Beheer

GP invests in the precision components manufacturer via Equistone Europe Partners VI

Verdane exceeds target for second Edda fund; closes on €540m

Fund exceeded its target of тЌ450m by тЌ90m and was "significantly" oversubscribed

GP Profile: Clessidra

CEO Andrea Ottaviano discusses the launch of the firm's last buyout fund, as well as dealflow and market perspectives in the wake of Covid-19

LP Profile: IMCO

Managing director Craig Ferguson discusses accelerated deployment activity during the pandemic and plans to scale up the PE allocation by 2025

ICG hires Bridge Valley's life sciences investment team

Allan Marchington, who will become head of ICG life sciences, says the team has a strong pipeline

Secondaries set for bumper year as dry powder overhang remains

The market is gearing up for a flurry of secondaries investing in 2021 with an estimated $61bn deployment target

New Baltic fund targets €30m to back female founders

Fund targets Baltic and Nordic startups with female founders and gender-balanced executive teams

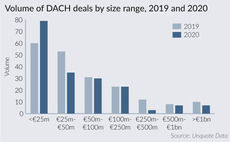

DACH small-cap deals weather the storm

Small-cap dealflow remained fairly stable in the DACH region in 2020, despite the coronavirus crisis

Heal Capital closes debut fund on €100m

Healthtech-focused VC sees opportunities in the developing European market, managing director Christian Weiß tells Unquote

Litorina, Bragnum back Nordic Surface Group

Litorina and Bragnum Invest will be co-owners alongside the management and local entrepreneurs, who remain significant co-owners

THI acquires road markings specialist WJ Group

WJ has a joint venture in Belgium, which it plans to grow, in addition to the firm's UK footprint

Volpi II closes on €323m

Founder Crevan O'Grady discusses the process and strategy with Katharine Hidalgo

Evolving VC landscape helps fuel venture secondaries

Backing a portfolio of companies after various funding rounds gives comfort to some investors, with valuations seen as more concrete

Patron closes sixth fund on €844m

Patron Capital VI is a closed-ended Jersey-based Limited Partnership, while Patron is based in London

DACH venture and growth deals peak in crisis

Following a strong year in volume terms, market participants remain optimistic about the resilience of the venture ecosystem

Montana Capital Partners closes OSP V on €1.3bn

MCP took eight months to raise the secondaries-focused fund, the GP said in a statement

Southern Europe's VC industry grows amid pandemic

VC ecosystem has not been immune to Covid-19, but has been able to react more promptly than traditional segments of the PE market

Covid-19 impact expected to be more severe than GFC – survey

Almost all Dechert survey respondents expect distressed deals to increase, while 82% cited more deal delays as an ongoing effect

Evoco increases stake in ReBuy

Evoco and its investment partners will now own a stake of more than 50% in the e-commerce platform

Unquote Private Equity Podcast: Nordic 2020 Review

Katharine Hidalgo welcomes Unquote Nordic reporter Eliza Punshi to discuss how dealflow and fundraising prospects are faring as 2021 rolls on

2021 Preview: Dry powder drives DACH prospects for 2021

DACH players adopted increased portfolio management and defensive investment decisions in 2020, but dry powder is set to drive 2021

Unquote Private Equity Podcast: DACH 2020 Review

Katharine Hidalgo welcomes Unquote DACH reporter Harriet Matthews to discuss how dealflow and fundraising prospects are faring as 2021 rolls on

Unquote Private Equity Podcast: France 2020 review

Katharine Hidalgo welcomes Unquote editor Greg Gille to discuss how dealflow and fundraising prospects are faring as 2021 rolls on

29% of LPs have decreased interest in emerging managers – survey

Placement agent Eaton Partnersт latest LP Pulse Survey collected responses from 61 LPs globally