DACH small-cap deals weather the storm

Small-cap dealflow remained fairly stable in the DACH region in 2020, despite the coronavirus crisis. Harriet Matthews reports on the drivers and opportunities in the segment

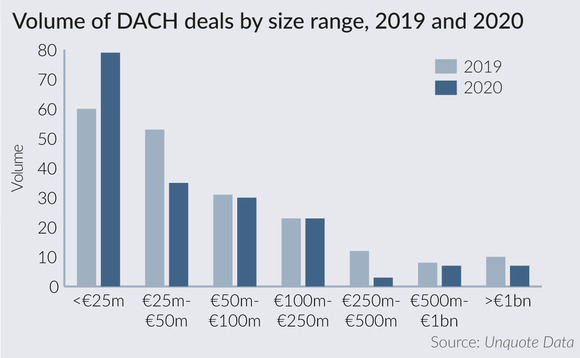

According to Unquote Data, buyout activity in the DACH region unsurprisingly slumped in 2020, recording 184 buyouts worth around €44.6bn, compared with 197 buyouts totalling €54.1bn in 2019.

However, deals valued at less than €25m had a market share of 43% in 2020, compared with 30% in 2019, and that small-cap segment was the only bracket to actually see deal activity increase.

Christoph Kauter, a managing partner at Beyond Capital Partners (BCP), says the pandemic did not have a significant impact on the firm's small-cap deal pipeline. "Last year, even though it was a 'Covid year' and from late March until end of June there was very little adviser activity, we still had 170 deals under review over the entire year. Usually we have 150-200, so this was not too different from other years. And debt and leverage availability was not as decisive a factor here as it was in the large-cap sector."

Large-cap processes, which are generally more likely to take place via heated auctions, faced challenges in 2020 in the DACH region and beyond. "As a buyer, if you are in an uncertain environment and there is a fully fledged auction where you might be paying 10-15x, you might ask yourself if you should be doing this deal right now," says Ralf Flore, managing partner at Ufenau Capital Partners. "Buyers would know that a) they might not get the financing; and b) as a fund manager, you have to ask if this is an appropriate valuation when there would be more visibility in 12 months' time. Many larger players are doing deals more selectively. If you are the owner and don't have to sell, that's the worst moment to do it. But the lower end of the market is more entrepreneurial and so deals can get done more easily."

Risks and opportunities

"The number of larger deals fell significantly in 2020, so it's not just that small-cap deals have grown, but it's a stabilisation," notes Sven Oleownik, partner and head of Germany at Gimv. "In these times, a lot of entrepreneurs are discovering that their companies might not be as stable or crisis-resilient as they expected. They can be very exposed, and the crisis is making them think about diversification, to build up a firewall. It's getting more and more important not to be exposed to the next potential crisis."

Bringing a partner on board can address some of these problems, Oleownik says: "Many want a partner to add money and to spread the risk, to grow with add-ons and internationalisation, or to get the skills on board that they are lacking."

Andi Klein, an investment advisory professional at Triton who is also responsible for the GP's Smaller Mid-Cap Fund, sees very little hesitancy from sellers at the lower end of the enterprise value spectrum: "We have seen entrepreneurs and owners in the small-cap range making the decision to sell, and they are not necessarily postponing conversations, since those are mostly bilateral to start with. These sellers still want to de-risk."

"In this segment, especially if it is a primary transaction, it's not only about the purchase price," says Kauter. "We usually acquire businesses at 5-6x, but a seller won't increase their sale price to the maximum – it's more about what the buyer is bringing, such as support for the future growth, or support from the buyer's existing portfolio companies."

Triton's Klein notes that securing financing can be difficult for deals in the €25m range. "While banks are generally cautious, it's clear that there is a lot of debt available and the leverage is unchanged for certain types of deals, namely for stable businesses with high cash conversion. But it is difficult for businesses that have been impacted, and banks perceive really small companies as higher risk due to their higher volatility – for example, they have more dependency on fewer people, and there is also usually no leverage or credit history." Many sponsors opted for all-equity deals to get transactions done, market sources told Unquote.

Pragmatism is key

However, Ufenau's Flore notes that due diligence can be less lengthy and complex for smaller businesses, which also means that they were less difficult to get done under coronavirus restrictions. "It's easier to analyse a company with €10-50m in sales than one with €500m-1bn that will depend more on macroeconomic factors and travel bans." Many sponsors also found ways around the issues of leverage or financial uncertainty, Flore says: "With smaller deals, you are closer to the entrepreneur, you can suggest earn-outs or reinvesting, and you have a more pragmatic and closer relationship."

Small-cap buyouts for asset-light deals proved popular in both 2019 and 2020 in the DACH region. Industrials and basic materials deals accounted for 41% of small-cap deals in the DACH region, compared with 37% in 2019, demonstrating the sector's continuing importance for small-cap sponsors and turnaround investors. However, the remaining 59% were for companies in the healthcare (8%), technology (23%) and consumer goods and services (28%) sectors.

"There could be an even sharper differentiation between the asset-light companies that we acquire and the asset-heavy ones in 2021," says BCP's Kauter, although he expects small-cap activity as a whole to remain fairly stable again in 2021. "Sponsors targeting asset-heavy businesses might want to acquire those later with more visibility, after Covid."

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds