Exclusive

EQT Growth's bet on maturing European startups

New growth investor plans to announce at least one deal by the end of the year, says partner Carolina Brochado

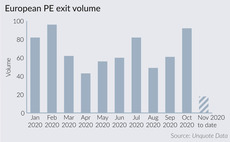

Private equity ramps up divestment efforts

Exit activity jumped by 50% in October, back to pre-pandemic levels, according to Unquote Data

ECI sells MPM to 3i for £170m

Other sponsors involved in the process included Livingbridge and Graphite Capital

Aleph, Crestview back Framestore's acquisition of C3M

The two GPs in 2014 formed a тЌ1.2bn strategic alliance to invest in companies based in the UK and Europe

Endless buys Hovis from Gores, Premier Foods

Endless invests in the business via its Endless Fund IV, which closed on ТЃ525m in December 2014

Buyout rankings: who has invested most across Europe since April?

EQT, Ardian and KKR remained very active and struck sizeable deals amid the coronavirus turmoil

Archeide launches €50m VC fund

Fund will target Italian startups developing innovative products and applications

Clessidra buys Coefi from Archeide

Sale ends an eight-year holding period for Archeide, which has supported the growth and expansion of Coefi since 2012

Italy Fundraising Pipeline - Q4 2020

Unquote compiles a round up of the most notable fundraises ongoing across the Italian market

Nordic Capital carves out RegTech from BearingPoint

GP followed the company for a long time and entered into exclusive negotiations with BearingPoint a few months ago

360 Capital to launch €50m Square II fund

360 Square II will deploy equity tickets of €500,000-3m, primarily across France and Italy

Preparing for the turnarounds wave

The much-anticipated wave of distressed opportunities has failed to materialise so far, but market participants are still readying for an uptick

Sponsor-lender relationship faces stiff Covid-19 test

GPs' relationships with their existing banks and debt funds will remain key to managing the ongoing consequences of the crisis

Download the November 2020 issue of Unquote

The latest issue of the Unquote magazine is now available to our subscribers

HV Capital announces eighth fund

GP has €535m in commitments; it has also rebranded from HV Holtzbrinck Ventures to HV Capital

Secondaries update: Unigestion's David Swanson

Secondaries activity is recovering from the initial coronavirus-related shock, with good prospects for GP-led secondaries deals

Ace buys Astorg's Aries Alliance, injects €20m in new money

Deal is the first for the aerospace-focused Ace Aero Partenaires fund, which reached a €630m first close

Digital doctors here to stay as telemedicine deals surge

Rise in demand for telemedicine т and promising returns for investors that have been targeting the space т looks set to continue

Tenzing backs MBO of VIPR

Deal is the ninth investment from Tenzing's debut fund, with its successor yet to deploy

German PE assesses opportunities in crisis

Panellists from PE and advisory firms discussed the role of private equity in the current deals landscape at Mergermarket's Germany Forum

Unquote Private Equity Podcast: Partnering for portfolio management

Oliver Jones and David Wardrop discuss the potential for new investment opportunities in a post Covid-19 environment

Finexx closes second fund; acquires Biovegan

GP's €20m vehicle plans to make three platform investments in total and has a full pipeline

Allocate 2020: CIO views on the road ahead

Catch up on a panel featuring leading international CIOs discussing their portfolio strategies for the coming five years

Video: IQ-EQ's Justin Partington

Unquote interviews Justin Partington from IQ-EQ, finalist in the Fund Administrator category at the 2020 British Private Equity Awards