Exclusive

Co-investment: get out or double down?

While some LPs could be overexposed to troubled sectors, others could up their game and deploy into opportunities arising mid-cycle

White Star holds first close for $30m Digital Asset Fund

Fund invests in blockchain-enabled businesses at each layer of the tech stack, with a focus on Europe and the US

GP Profile: Sparring Capital in final push for €200m fundraise

French GP, previously known as Pragma Capital, is aiming for a final close in the next six months, having collected around two thirds of its target

Download the October 2020 issue of Unquote

The latest issue of the Unquote magazine is now available to our subscribers

Arcano Secondary Fund XIV launches with €300m target

Fund will invest in mid-market buyout and growth capital vehicles across Europe and the US

GP Profile: Searchlight sees opportunity in volatility

Following an interim close for Searchlight Capital Partners' latest fund on $3.1bn, founding partner Oliver Haarmann details the firm's strategy

Italian PE players highlight silver linings amid crisis

Fundraising challenges, portfolio support and new opportunities were key themes discussed at last week’s Unquote Italian Private Equity Forum

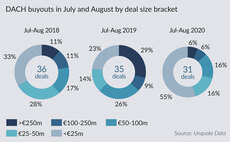

DACH buyout deal value sees sharp summer decline

Following a quiet period for upper-mid-cap dealflow, Unquote gauges market sentiment as to whether activity could pick up before year-end

LGPS hires Ian Brown as head of private markets

Ian Brown was previously head of the leveraged finance execution team at UBS

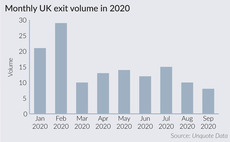

UK exits set to drag in Q3

Early figures from the third quarter suggest that very few GPs will be in sell mode for the rest of the year

Unquote Private Equity Podcast: Allocate 2020 special

The Pod discusses our upcoming LP/GP conference, Allocate, touching on illiquidity solutions, secondaries, and ESG

Notion IV to close in 2020 above £125m target

LPs in the fund include Nuclear Liabilities Fund, Pentland Group, Pool Reinsurance Company and Pruger

VC Profile: VNV Global

Managing director Per Brilioth discusses portfolio company Voi, seeking network effects and investing in companies at the idea stage

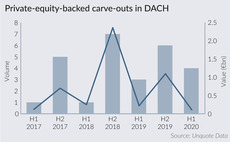

PE players await DACH carve-outs uptick

With corporates under pressure due to the coronavirus pandemic, opportunities are likely to open up for sponsors interested in carve-outs

MVI acquires majority stake in PS Auction

Deal is MVI's first investment from its second fund, which is aiming to reach its SEK 1bn target by Q1 2021

Ardian Expansion V closes on €2bn

Launched in January 2020, the fund's original target was €1.5bn - already 50% larger than its predecessor

Anima Alternative launches €200m direct lending fund

Fund will deploy financing to support the recovery and expansion of Italian SMEs operating in a wide range of sectors

Clean Growth Fund to close in 2021 on £150m hard-cap

Typical equity cheques will start at ТЃ500,000-3m for any initial investments

Talde launches €150m fund

Fund targets Spanish companies operating in a wide range of sectors, with revenues in excess of €20m

GP Profile: Sherpa Capital

Spanish GP Sherpa Capital has recently held a final close on €120m for its new fund Sherpa Special Situations III

Sagard NewGen holds first close for €300m first fund

Fund invests in majority and minority stakes of European companies with revenues of up to €150m

HIG European Capital Partners III sets target on €1bn

GP is also fundraising for HIG Europe Middle Market LBO Fund, which has a target of тЌ2bn

Secondary market update: coming out of hibernation

After a pause in activity, the market is gearing up for a busy final quarter, says Rede Partners' Adam Turtle

Anthemis venture fund to hold final close before H2 2021

To date, AIVGF I has secured backing from a number of investors such as NУМrnberger