Exclusive

Italian fundraising processes disrupted by Covid-19 crisis

A round-up of the processes affected, as well as those still pushing through despite the pandemic

Investcorp acquires Avira for $180m

Deal is the seventh from Investcorp Technology Partners IV, which held a final close on $400m in December 2018

Q&A: Cambridge Associates' Featherby on PE's time to shine

Very few managers will have net benefited from this crisis, says Featherby, but PE could still showcase its ability to outperform

How private equity is helping fight the Covid-19 outbreak

A round-up of initiatives by GPs across Europe т and their portfolio companies т to help their communities

Springrowth closes debt fund on €417m, plans new €200m rescue fund

Fund targets mid-market European companies generating EBITDA of at least €3m and revenues of €30-150m

Patrimonium holds €100m first close for debut fund

GP aims for final close within 12 months, despite the ongoing impact of Covid-19

ESG: PE leading the charge in CEE

Growing maturity of the market has been gradually bringing local standards up to western European levels

Welcome aboard: PE recruitment amid coronavirus

PE-focused recruiters and some GPs themselves are figuring out ways to progress recruitment processes, but challenges remain

Riello Investimenti launches €150m debt fund

Fund is larger than its predecessor, Impresa Italia Private Debt I, which raised €70m in 2016

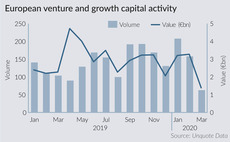

VC, growth activity collapses in March amid Covid-19 outbreak

European VC and growth capital dealflow was no more sheltered than its buyout counterpart

Unquote Private Equity Podcast: Covid-19 special

The team gathers for its first remote podcast, discussing how the early stages of the outbreak have disrupted the European PE landscape

Debut managers to face daunting fundraising market in 2020

Debut managers out to market are unlikely to hold closes in 2020, and very few new teams are likely to launch funds

VC Profile: Speedinvest

Seed investor is opening a new office in Paris as part of the expansion of its pan-European platform

Secondaries: opportunistic buyers ready for fund stakes to hit market

With more sellers coming to market, prices are unlikely to stay at pre-Covid-19 heights, which could in turn encourage more opportunistic buyers

LP Profile: Kåpan Pensioner

Mikael Falck, head of alternatives, discusses the Swedish pension fund's appetite and exposure to the asset class

Preservation Capital Partners Fund I holds first close

To date, PCP I has mainly institutional investors from both North America and Europe

French PE steps up gender diversity goals and monitoring

French private equity association France Invest launched its gender-parity charter at IPEM

German VCs call for more Covid-19 startup support

Concerns centre around the profitability criteria, as well as local banks' lack of familiarity with startups' risk profile

Generalitat Valenciana to launch €200m coronavirus fund

A private equity firm will be selected by the Institut Valencià de Finançes to manage the new vehicle

Annual Buyout Review: European momentum likely to be hit hard

Unquote's lastest Annual Buyout Review is now available to download, offering in-depth statistical analysis of European buyout activity in 2019

Italy embarks on the "deep tech" revolution

"Deep tech" startups specialise in transformative technologies, such as nanotechnology, industrial biotech, and advanced materials

UK industry welcomes rescue package, but concerns remain

Package includes ТЃ330bn in loans, ТЃ20bn in other aid and a postponement of business rates

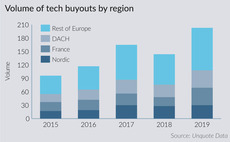

Technology buyouts stall in Nordic region

Technology buyouts have hovered around the 30-per-year mark for three years running now, suggesting a plateau has been reached

UK sees advisory boom amid PE market maturation

UK & Ireland sees an increase in the number of corporate finance firms participating in PE deals to more than 160