VC, growth activity collapses in March amid Covid-19 outbreak

European VC and growth capital dealflow was no more sheltered than its buyout counterpart in March, with Unquote Data recording the lowest monthly activity tally in years.

One could have thought that venture and growth capital activity would be less impacted than buyouts amid the early stages of the coronavirus outbreak, sheltered from the need to navigate the flash drought of debt financing and the rapid collapse of M&A processes.

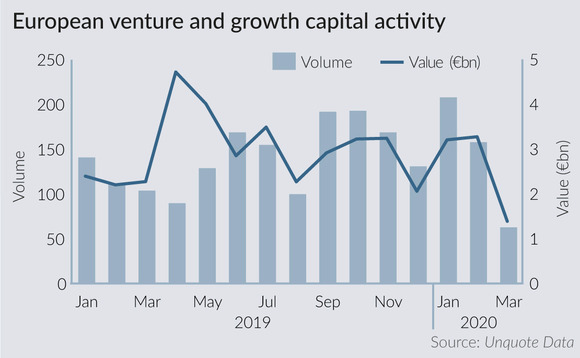

But Unquote Data shows that this segment of the market was dealt a crushing blow in March: just 63 funding rounds and capital injections were recorded across Europe, a 60% drop on the 158 deals inked in February, and an even steeper plunge from the 208 transactions that took place in January.

This is also the joint lowest volume total recorded in more than six years, matching the commonly sedate August in 2016.

By comparison, buyout activity dropped by "only" 31% month-on-month – although an important caveat is that the timing of deals progressing and officially crossing the finish line is usually much more elongated for buyouts, meaning that a large portion of March activity will reflect the pre-outbreak market of early Q1. The full scope of the buyout slowdown is likely to be coming through in Q2 statistics.

Comparing year-on-year monthly activity, the venture and growth drop was slightly less vertiginous, considering March 2019 was home to a relatively low number of deals (104).

In aggregate value terms, the slowdown was equally precipitous, but more in line with some quieter periods in recent years. The March 2020 funding rounds and growth capital injections were worth a combined €1.39bn, compared with €3.27bn in the preceding month and €2.27bn in March last year.

This partly reflects the fact that European funding rounds are on average larger than they were in the pre-2016 years. But a handful of standout deals also went through last month, including General Atlantic leading a $130m series-B funding round for biotechnology company Immunocore, and DMG Ventures (the venture arm of Daily Mail and General Trust) heading a £100m round for online car buying marketplace Cazoo.

The activity drop was also much more noticeable in some European regions. France, southern Europe and DACH all saw dealflow plunge by around 70% between February and March. Meanwhile, the UK was relatively more resilient, albeit at very low historical levels, with a 42% month-on-month decrease.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds