Fondo Italiano di Investimento

Basalt Infrastructure Partners backs Caronte & Tourist

GP acquires a 30% stake in the company, investing via its Basalt Infrastructure Partners II fund

FII acquires Fonderie di Montorso

GP will support the company's expansion and create a pool of businesses specialising in iron casting

FII, Hat Orizzonte acquire Marval

FII invests €34m in the auto parts manufacturer and acquires a majority stake

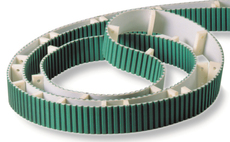

Partners Group buys Megadyne in SBO

Company's founders, the Tadolini family, reinvested in the business alongside Partners Group

Neuberger Berman exits Rigoni di Asiago

In addition to Neuberger Berman's holding, Kharis acquires a minority stake from the Rigoni family

FII leads €13m round for Supermercato24

Company will use the fresh capital to bolster its growth in Italy and expand abroad

NB Aurora buys stake in FII's portfolio

Stake acquired by NB Aurora is made up of minority holdings in 17 Italian companies

P101 holds first close on €65m for second VC fund

Fund targets digital and technology startups offering B2C and B2B services to various industries

Fondo Italiano to launch two funds-of-funds

FoF PE II will target private equity funds that invest in Italian SMEs operating in the tech sector

Neuberger Berman exits Surgital, Brugola

Neuberger Berman acquired Fondo Italiano's portfolio, which included Surgital and Brugola, last year

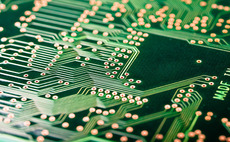

Fondo Italiano invests €10m in Seco

Computer components company will seek to pursue international expansion and make bolt-on deals

Five Seasons Ventures holds first close for maiden fund

French VC firm's first fund, dedicated to agriculture technology, holds a €60m first close

United Ventures holds €75m first close for sophomore fund

Venture capital fund will make early-stage investments in software, ICT and digital tech companies

Neuberger Berman acquires FII's portfolio

Portfolio of 21 companies has a combined turnover of €2.3bn and EBITDA of €282m

Fondo II Tech Growth in €9m funding round for BeMyEye

Fondo Italiano d'Investimento's tech growth fund contributes €6.3m to the round

FII holds first closes for PE and VC vehicles

Italian sovereign fund Cassa Depositi e Prestiti acted as anchor investor for the two vehicles

Fondo Italiano hits €163m final close for VC fund-of-funds

Following the recent €3m commitment of Fondazione Cariparo, the fund hit a final close on €163m

Neuberger Berman in exclusive negotiations for FII's portfolio

Exclusivity ends the bidding process for the portfolio, which also attracted Tikehau and Italmobiliare

Tikehau, Italmobiliare make offer for Fondo Italiano portfolio

GPs set up an equally split joint venture to acquire FII's portfolio of assets

FII sells Antares back to founders

After five years of PE support, the business reverts to complete control by its founders

Fondo Italiano d'Investimento exits Emarc via trade sale

GP sells its holding in the Italian auto parts producer after a five-year ownership period

Fondo Italiano commits €85m to 3 Italian private debt funds

Following announcements, Quadrivio holds €120m first closing for its maiden debt fund

CDP's Valvitalia buys Nuova Giungas from Xenon and Finint

As part of the deal, existing shareholders fully exited the Modenese business

Fondo Italiano d'Investimento appoints Mammola as CEO

Italian state-backed fund-of-funds nominates a new CEO and confirms Cipolletta as chair