Livonia Partners

Livonia holds first close on EUR 147m

Fund was launched in 2020, with a hard-cap set at EUR 170m

Livonia sells Thermory to UG Investeeringud

UG Investeeringud had previously been a minority shareholder of the company

Livonia-backed Thermory buys Siparila

Latvian private equity firm Livonia backed the bolt-on via its first fund, Livonia Partners Fund I

Livonia Partners to launch new fund

New fund expects to raise in 12 months and will deploy equity tickets in the range of €10-20m

Livonia Partners leads $5.2m series-A for Scoro

Previous backers Inventure and Tera Ventures also take part in the funding round

Livonia acquires stake in Freor

Deal comes after establishing a long-standing relationship with the company's founder over five years

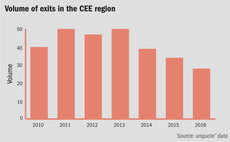

CEE exit activity picks up in Q1 as buyouts drop

First quarter saw a significant drop in both buyout volume and aggregate value in the region, though the number of exits is up, year-on-year

Tech deals return to the CEE region

Tech activity in CEE remains sluggish, though aggregate values are on the increase

Livonia buys minority in CGates

Deal is the fourth for the GP's Baltic mid-cap-focused fund Livonia Partners Fund I

Dino Polska IPO could revive public exit route for PE in CEE

Public market exit route has been in decline for central and eastern European private equity since its 2013 post-crisis peak

Livonia completes third deal with Santa Monica Networks MBO

The deal sees Livonia tap its maiden fund to acquire Santa Monica's Latvian and Lithuanian operations

Mega-deals cap good year in CEE

Region registers two €500m-plus deals in the final quarter of a strong year for private equity

CEE could arrest exit flow decline in 2016

Region is seven exits short of exceeding 2015’s total for PE- and VC-backed exits

Livonia Partners buys garden centre Hortes

GP completes second buyout from maiden vehicle with Estonian retail business

Baltic VCAs band together to form regional association

The three Baltic countries’ lobbying organisations have joined forces to promote the industry

Livonia makes 10x on Qvalitas sale to BaltCap

Baltic GP earns 44% IRR over seven years on exit of final legacy portfolio asset

Livonia reaps 2x on exit of legacy asset Archyvų Sistemos

Baltic archiving services company was a legacy asset from a portfolio that pre-dated Livonia’s maiden fund

Deal in Focus: Livonia makes maiden deal with Ha Serv

Estonian wood products company becomes first acquisition from Baltic GP’s inaugural fund

Building Baltic bridges vital to region's buy-and-builds

Strategies to build out portfolio companies into neighbouring countries could provide welcome growth

Origination: perfecting processes

Part two of our Origination Series looks at processes and intermediaries

Bright future: Investment opportunities in Estonia

Success of Estonian startups could see larger deals and funds for the Baltic countries

Onshoring debate: the Latvian card

Latvia looking to bank on onshoring trend to attract Baltic-focused GPs

Livonia Partners holds €70m first close for inaugural fund

Fundraise exceeds first-close target by €20m