Morgan Stanley

Morgan Stanley nears EUR 1.6bn-plus first close for maiden European direct lending fund

Investment manager started marketing fund to LPs last year; expects to raise in excess of EUR 3bn

Carlyle hires advisers to explore DEPT sale in 2023

Morgan Stanley and Jefferies will guide GP on potential exit of Dutch digital agency

Morgan Stanley equity solutions MD departs

Gautier Martin-Regnier has left after nine years at the bank; expected to join sovereign wealth fund

Ardian's Dedalus sale postponed until September

Owners of Italian software group in “wait-and-see mode” as M&A faces challenging environment

Nordic Capital readies Signicat for dual-track exit process

Morgan Stanley appointed to guide on options for Norwegian digital identity and signature solutions provider

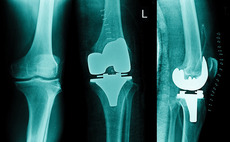

EQT pauses LimaCorporate auction

Sponsor is expected to reassess options for the Italian orthopaedic prosthetics producer after new CEO appointment

Ardian readies Dedalus for controlling stake sale

Morgan Stanley and UBS are preparing an auction for the Italy-based hospital software group

ArchiMed circulates teasers for Bomi auction

Healthcare-focused logistics company is being marketed off EUR 40m EBITDA

SD Worx minority stake sale process attracts PE interest

Morgan Stanley is in pole position to secure the sellside mandate for the Belgian HR and payroll software group

Inspired Education stake sale attracts Blackstone, EQT, H&F, KKR

Information memorandums for the GIC- and TA Associates-backed national schooling company should be circulated next week

ArchiMed preps Bomi auction

ArchiMed launched a EUR 70m takeover bid for Bomi in March 2019

Vitruvian's Bitdefender hires advisers for IPO-led exit

Romanian cybersecurity company appoints JP Morgan and Morgan Stanley for a dual-track process

EQT looking at Sitecore stake sale

Morgan Stanley and Goldman Sachs are advising the Swedish buyout group on the process

Bregal kickstarts ATP sale process; Morgan Stanley advises

Tapes specialist is expected to generate EUR 45m in EBITDA from EUR 175m in sales this year

Investindustrial exits Polynt-Reichhold in buy-back

Asset was expected to fetch around тЌ2.5bn, with Lone Star previously thought to be in exclusivity

CVC buys Ethniki Insurance in €505m deal

GP invests in the company via CVC Capital Partners VII, which closed on €15.5bn in June 2017

Summa-backed Olink files for US IPO

Olink has been backed by Summa Equity since March 2019 and increased its revenues by 16.7% in 2020

Permira-backed Dr Martens prices IPO with valuation of £3.7bn

During Permira's holding period, the boot maker's turnover has grown from ТЃ209m in 2014 to ТЃ672m in 2020

Nordic Capital launches $2bn take-over for Advanz

Advanz Pharma initially hired Jefferies to advise on a sale process in October 2020

Permira-backed Dr Martens to publish IPO prospectus

Morgan Stanley and Goldman Sachs are the joint global co-ordinators on the listing

Blackstone, Carlyle in talks to take Signature Aviation private

Blackstone is currently investing from Blackstone Capital Partners VIII, which closed on $26bn

Permira hires Goldman Sachs, Morgan Stanley for Dr Martens' IPO – report

Permira acquired the brand in 2013 for ТЃ300m, with debt provided by Barclays

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

BC Partners backs Ima in €3.6bn deal

BC Partners and Sofima will launch a mandatory tender offer to acquire all remaining Ima shares