Nordic Capital

Nordic Capital acquires Tokmanni from CapMan

Nordic Capital has acquired Finnish discount retailer Tokmanni Group from CapMan.

Nordic Capital et al. sell Nycomed spinoff Fougera for $1.5bn

Nordic Capital, DLJ Merchant Banking Partners (DLJMB), and Avista Capital Partners have sold US-based Nycomed spinoff Fougera to Swiss trade player Novartis for $1.525bn.

EQT buys Anticimex from Ratos

EQT has acquired 100% of the Anticimex Group from Ratos in a tertiary buyout.

Nordic Capital in Bladt SBO

Nordic Capital has acquired Danish steel contractor Bladt from Maj Invest and Industri Udvikling.

Nordic Capital cleared to take Orc Group private

Nordic Capital is expected to delist NASDAQ OMX-listed financial technology and service provider Orc Group in mid-February.

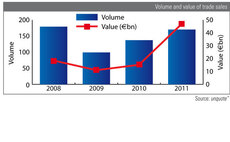

Trade sale values boom in 2011

Trade sales continue to be the most common exit route in 2011 and increased by almost €30bn in value, while secondary buyouts are stalling, reflecting the tough economic conditions of the past year. Anneken Tappe reports

2011 exits: trade sales almost triple in value

As the graph shows, the proportion of trade sales, the most common exit route, has not changed significantly between 2010 and 2011.

Could mega fundraisings cause Nordic dry powder problem?

International investors have driven Nordic fundraising to unprecedented levels, but will deal flow keep up with the dry powder? Sonnie Ehrendal investigates.

IK Investment Partners hit by carried interest row

The Swedish tax authority's battle over carried interest taxation continues as another player is drawn into the feud. Sonnie Ehrendal investigates.

CVC and Nordic Capital's LEAF in reverse takeover with Cloetta

CVC Capital Partners and Nordic Capital have exited portfolio company LEAF to listed trade player Cloetta in a reverse takeover.

Nordic Capital bids for Orc

Nordic Capital has made a bid for NASDAQ OMX-listed financial technology and service provider Orc Group.

Rumour roundup: what to expect in 2012

With 2012 just around the corner, the market is abuzz with rumours. Sonnie Ehrendal takes a look at what to expect in the coming year.

Apax and Nordic Capital-owned Capio acquires three clinics

Apax Partners and Nordic Capital's portfolio company Capio AB has acquired the French Aguilera, and Swedish CFTK and Avesina clinics.

Nordic Capital exits Point Group

Nordic Capital has exited electronic payments company Point Group to NYSE-listed VeriFone.

EQT acquires Atos from Nordic Capital

EQT has acquired Swedish medical device company Atos Medical from Nordic Capital.

Nordic heading for fourth exit of 2011

Final bids are due tomorrow for Swedish medical devices company Atos, currently owned by Nordic Capital.

Nordic Capital eyeing Point International sale

Nordic Capital is believed to be looking to sell Swedish payment service provider Point International, according to reports.

Nordic Capital's Nycomed in possible €8bn sale

Nordic Capitalтs portfolio company Nycomed has received interest from Japanese pharmaceutical company Takeda Pharmaceutical, according to reports.

Nordic Capital's FinnvedenBulten IPO back on track

Nordic Capital has got its IPO plans back on track for Swedish auto parts manufacturer FinnvedenBulten.

Nordic Capital's Falck share sale ends IPO deliberations

Nordic Capital has sold its remaining shares in Danish ambulance and fire engine service provider Falck A/S to Lundbeck Foundation, KIRKBI, PFA and the companyтs executive management board.

EQT and Nordic Capital looking to raise new funds

EQT and Nordic Capital are in the early stages of fundraising, according to reports.

Nordic Capital wins tax case

The tax board has rejected the claims of the tax agency regarding Nordic Capitalтs taxing of profit sharing between 2006 and 2007.

Nordic Capital partially exits Falck

Nordic Capital, ATP Private Equity Partners and Folksam have sold a 36% stake in Falck to The Lundbeck Foundation.

Private equity firms interested in ISS

Private equity firms are looking to acquire Danish cleaning services provider ISS as the deadline for the first round of the sales process nears, according to reports.