Partners Group

Partners Group's private equity AUM increases 7%

Switzerland-based firm announces тЌ2.37bn new commitments for its private equity strategy

Partners Group buys Megadyne in SBO

Company's founders, the Tadolini family, reinvested in the business alongside Partners Group

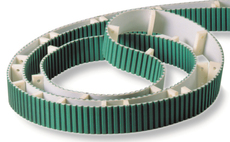

Partners Group buys Ammeraal Beltech in SBO

Advent International sells Netherlands-based Ammeraal, a lightweight belting specialist

Partners-led consortium buys Techem for €4.6bn

Deal ends a 10-year holding period for Macquarie, which took the firm private in 2008

Partners Group launches impact fund

Move follows impact fund launches from global PE firms TPG, KKR and Bain Capital in recent months

Ardian sells Groupe Bio7 to trade

Buyer Cerba HealthCare is owned by Partners Group and Canadian pension fund PSP Investments

Partners Group appoints Steffen Meister as chair

Meister succeeds Peter Wuffli, who has been chair since 2014 and who will now act as vice-chair

European PE in 2017: Scaling new heights

Buyout activity and fundraising reached a new peak in 2017, with mega-buyouts and small-cap deals fueling dealflow and French funds popular among LPs

Partners Group makes 6x return, 74% IRR on VAT Group final exit

GP originally acquired a joint majority stake alongside Capvis Equity Partners in December 2013

Partners Group reaches €61.9bn in AUM

Private debt is the fastest growing allocation area for the firm, with new commitments of тЌ3.5bn

Partners Group sells 9.33% stake in VAT Group

Further sell-down amounts to CHF 355m and leaves Partners Group with a stake of 3.75%

Partners Group sells 10% VAT Group stake

Partners Group will retain a 13.07% stake in VAT Group after the settlement of the transaction

Partners Group raises €6bn for direct private equity

Partners Group Direct Equity 16 has closed on €3bn after holding a first close on €1.5bn in February 2017

Omers makes 2.6x on £1bn sale of Civica to Partners Group

Sale ends a four-year holding period for Omers, which bought Civica from 3i for ТЃ390m in 2013

Phoenix sells Key Retirement to Partners Group for £200m

New funding will be used to expand the companyтs distribution capacity and drive product innovation

Partners Group holds €1.5bn first close for direct investment fund

Buyout firm acquired French pharmaceutical group Cerba HealthCare for €1.8bn from PAI Partners earlier this year

PAI exits Cerba Healthcare in sale to Partners Group

PAI is exiting the group after a six-year holding, during which Cerba's turnover tripled

unquote" LP and secondaries round-up

European fund-of-funds managers look to raise new vehicles, LPs increase private equity allocations, and more in this unquote" round-up of LP news

unquote" LP and secondaries round-up

US and European LPs bring PE investments in-house in our latest round-up of LP and secondaries news

Luxembourg launches Reserved Alternative Investment Funds

New vehicles will increase flexibility and open up opportunities for private equity houses, real estate investors and hedge fund managers

Partners Group targets UK defined contribution market with new fund

Partners Group Generations Fund is structured as a non-UCITS retail scheme

Partners Group closes sixth secondaries fund on €2.5bn

Its previous vehicle, Partners Group Secondary 2011, reached a final close on €2bn in 2012

Polaris exits A-Tex to Partners Group's Trimco

Exit comes three years after acquisition

Partners Group takes minority stake in Tous

Founding family will keep majority control of luxury goods maker