Secondary buyout

Investcorp buys snack manufacturer Tyrrells for £100m

Investcorp has acquired Tyrrells Potato Crisps, a UK-based manufacturer of crisps and snacks, from Langholm Capital for ТЃ100m.

Pamplona set to buy OGF from Astorg

Pamplona Capital Management is set to acquire French funeral services provider OGF from Astorg Partners, a deal reportedly valued at around €900m.

Aheim achieves 2.4x on Aqua Vital exit

Aheim Capital has sold water cooler provider Aqua Vital Quell-und Mineralwasser to fellow German private equity firm Halder, reaping a 2.4x gross money multiple.

Battery Ventures buys IHS from Kings Park Capital

Kings Park Capital has exited German marketing company IHS to a newco backed by Battery Ventures, reaping a 3.8x gross money multiple.

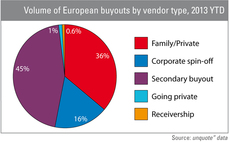

"Pass-the-parcel" deals creep up in H1

Secondary buyouts have accounted for 45% of the overall number of buyouts in the first half of 2013, the highest proportion witnessed since the onset of the financial crisis, according to unquote" data.

EdRip backs DufyElec in SBO

Edmond de Rothschild Investment Partners (EdRip) has acquired a minority stake in DufyElec from the company’s private equity owner Naxicap Partners.

Towerbrook acquires majority stake in Metallum

Towerbrook Capital Partners has acquired a majority stake in Metallum Holding, a Luxembourg-domiciled metal refining and recycling company, from private equity firm Groupe Alpha.

ECI sells CliniSys to Montagu, reaps 2.5x return

ECI Partners has sold CliniSys, a provider of IT systems to the healthcare sector, to Montagu Private Equity, reaping a 2.5x money multiple on its investment.

Nordic Capital exits EG, reaps 4x money

Nordic Capital has agreed to sell Danish IT software and services provider EG to Axcel for тЌ160-170m, reaping a 4x money multiple and a 30% IRR.

Bain to buy Maisons du Monde from Apax, LBO France

Bain Capital has agreed to acquire French home decorations and furniture retail business Maisons du Monde in a secondary buyout understood to be worth around €650m – close to 8x EBITDA.

Springer Science: EQT opts for €3.3bn sale to BC Partners

EQT Partners and the Government of Singapore Investment Corporation (GIC) have agreed to sell German media publisher Springer Science to BC Partners for €3.3bn.

Eurazeo acquires IES from Demeter

Eurazeo Croissance has acquired a 93% stake in the secondary buyout of electric vehicle chargers manufacturer IES Synergy from Demeter Partners.

ECM sells Kadi to Paragon

ECM Equity Capital Management has sold its majority stake in Kadi AG, a Swiss frozen food manufacturer, to Paragon Partners and the company’s management team.

Axa PE buys Trescal in €250m SBO

3i stands to double its money in a little less than three years after agreeing to sell French measurement services specialist Trescal to Axa Private Equity for around €250m.

Bridges sells The Gym Group to Phoenix

Bridges Ventures has sold a majority stake in The Gym Group to Phoenix Equity Partners, realising a 3.7x money multiple and a 50% IRR.

HG International trades hands between Gilde funds

Gilde Equity Management Benelux (GEM) has sold Dutch cleaning products supplier HG International BV to the GP's sister division, Gilde Buyout Partners (GBP).

Doughty divests Vue to Omers and Alberta for £935m

Doughty Hanson has sold cinema group Vue Entertainment to Omers Private Equity and Alberta Investment Management Corporation (AIMCo) for an enterprise value of ТЃ935m.

Vermeer Capital buys RLD from Sagard

Vermeer Capital has acquired a majority stake in RLD, a French business specialising in the rental and laundering of workwear, from fellow GP Sagard.

Montagu sells Hansen Protection to IK

Montagu Private Equity has agreed to sell Norwegian protective clothing company Hansen Protection to IK Investment Partners.

Lion cleared to sell Ad van Geloven stake to Avedon

Lion Capital has received clearance from the European Commission to sell a stake in Dutch frozen snack company Ad van Geloven to Avedon Capital Partners.

Rutland picks up Equistone's AFI-Uplift

Equistone Partners Europe has offloaded AFI-Uplift to Rutland Partners in a deal that combines three companies for a total enterprise value of around ТЃ85m.

AnaCap sells Cabot to JC Flowers

AnaCap Financial Partners has sold Cabot Credit Management (CCM) to JC Flowers in a secondary buyout worth a reported ТЃ800m.

3i sells HTC Sweden to Polaris Private Equity

3i has sold its 36.5% stake in flooring solutions manufacturer HTC Sweden to Polaris Private Equity.

PAI partners sells FTE Automotive to Bain, reaps 3.3x overall return for fund III

PAI partners has agreed to sell its 90% stake in German hydraulic clutch and brakes provider FTE Automotive to Bain Capital in a secondary buyout.