Secondary buyout

EQT exits BTX Group to Sun European Partners

EQT has agreed to sell Danish apparel company BTX Group to Sun European Partners.

Cobepa buys Socotec from Qualium

Investment holding Cobepa has acquired a majority stake in French management consulting firm Socotec from Qualium Investissement, alongside private equity investor Five Arrows and management.

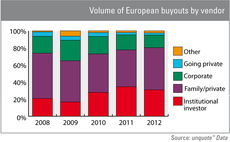

SBOs subside in 2012

Following a record 2011, the volume of “pass-the-parcel” deals abated slightly last year – but primary transactions still have a long way to go before returning to their pre-crisis glory.

N+1 buys Probos from Explorer

N+1 Private Equity has acquired Portuguese plastic band manufacturer Probos in a €75m SBO from Explorer.

Capiton buys Kautex Maschinenbau from Steadfast

Capiton AG has acquired German manufacturer Kautex Maschinenbau in an SBO from Steadfast Capital valued at €50-100m.

Equistone IV to sign ninth deal

Equistone Partners, which has recently closed its Equistone IV fund on €1.5bn, is set to acquire French food machinery business Groupe Brétèche, according to a filing made with the French competition authority.

Siparex et al. take stake in Malherbe SBO

A consortium led by Siparex has backed the tertiary buyout of French transport group Malherbe from Nixen Partners.

Alliance Entreprendre takes majority stake in Marline

Alliance Entreprendre is believed to have taken a majority stake in the SBO of French motor fuel producer Marline from Initiative & Finance.

Siparex and Somfy buy Sofilab

Siparex and Somfy Participations have taken a majority stake in Groupe Sofilab, a French producer of livestock watering troughs.

EdRip et al. support Groupe Marietton OBO

Edmond de Rothschild Investment Partners (EdRip), Crédit Agricole Régions Investissement and Siparex have backed the secondary owner buyout of French travel specialist Groupe Marietton.

EdRIP invests in secondary OBO of Itesa

Edmond de Rothschild Investment Partners (EdRIP) has taken a minority stake in the owner buyout of French security equipment distributor Itesa, allowing existing backer MBO Partners to exit the business.

FSN Capital to buy Troax from Accent Equity

FSN Capital has agreed to acquire Swedish property protection company Troax Group AB from Accent Equity.

21 Centrale buys Oberthur from TCR Capital

21 Centrale Partners has bought French stationery manufacturer Oberthur from TCR Capital.

Gimv buys ProxiAD from UI Gestion

Gimv has acquired a majority stake in French software engineering services provider ProxiAD from UI Gestion.

CVC buys Cerved from Bain Capital and Clessidra for €1.13bn

CVC Capital Partners has acquired Italian business intelligence provider Cerved from Bain Capital and Clessidra for €1.13bn.

Quadriga to buy LR Health and Beauty Systems from Apax

Quadriga is the final bidder for German beauty products retailer LR Health and Beauty Systems (LR International), currently owned by Apax Partners, according to reports.

LBO France buys Alvest off AXA PE and Equistone

LBO France has acquired French industrial group Alvest from AXA Private Equity and Equistone.

Reiten exits Basefarm to ABRY

Nordic private equity firm Reiten & Co has sold Norwegian IT company Basefarm to US-based ABRY Partners.

ICG backs MBO of ATPI from Equistone

The management team of UK-based travel management business ATPI has bought the company from Equistone with support from ICG.

Dunedin reaps 3x money multiple on etc venues exit

Dunedin Capital Partners has exited UK-based conference and training venues business etc venues in an SBO to Growth Capital Partners (GCP), reaping a 3x money multiple on its original investment.

Alto makes 2x on Monviso SBO

PM & Partners Private Equity has acquired Italian food producer Monviso from Alto Partners.

DBAG acquires Heytex Bramsche from NORD Holding

Deutsche Beteiligungs AG (DBAG) has acquired Heytex Bramsche, a German manufacturer of print media and technical textiles, in an SBO from NORD Holding.

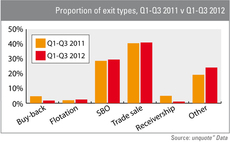

Exit routes: secondary buyouts gain popularity

Secondary buyouts have seen their share of the exit market rise, while trade sales hold steady, according to the latest figures from unquote” data.

Nazca buys Ovelar for €28m

Spanish GP Nazca Capital has wholly acquired visual merchandising company Ovelar Merchandising for €28m.