Small-cap buyout

Buyout market could see worst year since 2009

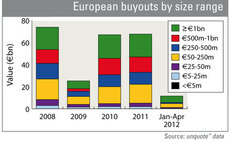

Latest figures show Europe's buyout market has failed to recover from the market malaise of late 2011, brought on by the Eurozone crisis, particularly at the upper end of the market.

Buyout market could see worst year since 2009

Latest figures show Europe's buyout market has failed to recover from the market malaise of late 2011, brought on by the Eurozone crisis, particularly at the upper end of the market.

French asset manager launches PE unit

Meeschaert Capital Partners, focusing on growth capital and small- and mid-cap buyouts, has been established by French asset management group Meeschaert Gestion Privée.

€30m first close for TCR Capital

French GP TCR Capital has raised around €30m for its latest fund, a small-cap buyout vehicle.

The unquote" forecast: Buyout activity approaches 2008 levels

Propped up by a strong third quarter, European buyout activity should exceed the overall value invested in 2008 by the end of this year, but may fall short volume-wise. Greg Gille reports

AXA invests in Ticket Surf International

AXA Private Equity has acquired a 25% stake in French provider of e-money services Ticket Surf International (TSI) as part of an owner buyout.

Constellation Capital launches €100m fund

Constellation Capital has launched its first institutional fund, Constellation II German Small Cap Fund, targeting €100m.

Constellation Capital adds new managing partner

Ralf Flore has joined Swiss investor group Constellation Capital as managing partner.

Auctus closes third fund on €155m

Auctus Capital Partners has closed its latest fund Auctus III at a revised hard-cap of €155m following a substantial over-subscription.

IDIA and Liberfy acquire 66% of Gyma

IDIA - a Crédit Agricole fund focusing on the agrifood sector - and industrial holding Liberfy have acquired 66% of troubled French food producer Gyma.

Socadif backs SPAS MBI

Socadif has backed the management buy-in of French events organiser SPAS.

Crédit Agricole PE appoints new investment director

Crédit Agricole Private Equity has appointed François Lory as investment director in its small-cap team.

Trilantic Capital to buy Gamenet

Lehman Brothers spin-out Trilantic Capital is on the brink of purchasing Italian slot machine operator Gamenet for €50m.

German buyouts: the giant stirs?

Despite encouraging macroeconomic signs and increasing buyout activity elsewhere, the level of deal completions in the German buyout market remains well below par. What chances are there of an up-tick in this giant market? Julian Longhurst investigates....

Auctus launches third fund

German private equity house Auctus Capital Partners is looking to raise €150m for its latest vehicle AUCTUS III.

Energy Ventures lead NOK 170m buyout of Read Well

Energy Ventures has, alongside Viking Venture, KLP and management, wholly acquired oil & gas services provider Read Well Services (RWS), valuing the business at NOK 170m.

Ambienta acquires 60% stake in Ecotek

Specialist environmental investor Ambienta has acquired a 60% stake in alternative fuel producer Ecotek. The balance is retained by the Ravelli family.

Elysian Capital acquires Vertical Pharma Resources

Elysian Capital has backed the management buyout of pharmaceutical supplier Vertical Pharma Resources Limited. Two of the original four founders of the business, trading as Integrated Pharmaceutical Services (IPS), have fully exited.

GED acquires 70% stake in EP4

Spanish private equity investor GED has acquired a 70% stake in engineering business Estudio Pereda 4 (EP4).

GED acquires Infopress

Spain-based investor GED Capital has acquired a 92% stake in Romanian printing services provider Infopress Group.

Private equity activity subdued despite industry optimism

European private equity remained subdued in early 2010 despite relative optimism over the economy, according to the unquoteт Private Equity Barometer.

Yacht investments - private equity is back in the regatta

Private equity backers sunk a lot of money into yacht builder deals during the peak of the buyout boom, taking control of the biggest brands in the industry within just a few years. In many cases, the outcome has been disastrous. Now, a private equity...

Afinum acquires Sinnex

Afinum Management has acquired luxury yacht outfitter Sinnex Holding GmbH, which encompasses Sinnex Steinheimer Innenausbau GmbH based in Steinheim an der Murr and Sinnex Innenausbau GmbH based in Griffen, Austria.

Equita acquires Isolite Holding GmbH

Equita has acquired 100% of Isolite Holding GmbH from a private owner and Cornerstone Capital, which held 40% of the company.