Take Private

Bain-led consortium makes €2.1bn offer for Ahlstrom-Munksjö

Consortium has offered тЌ18.10 per share, 24% higher than the тЌ14.56 closing price on 23 September

Madison Dearborn acquires IPLP for C$981m

CDPQ, the companyтs largest shareholder, will retain 24.9% of shares through a subsidiary

BC Partners backs Ima in €3.6bn deal

BC Partners and Sofima will launch a mandatory tender offer to acquire all remaining Ima shares

Eurazeo to acquire EasyVista in €131m deal

Following the deal, Eurazeo will file a public offer targeting all remaining securities of the company

Blackstone to continue preparations to acquire NIBC

Blackstone's offer comprises 995 euro cents per share, including the final dividend of 33 cents

Huntsworth board accepts £524m offer from CD&R

Takeover offer implies an entry multiple of 10.8x adjusted EBITDA of ТЃ48.4m

Triton buys 76% stake in Renk

Parent company VW began looking for strategic options for the company in May 2019

Advent completes £4bn acquisition of Cobham

Advent drew equity from its $17.5bn Advent IX vehicle, which writes equity tickets of $100m-1bn

Mayfair-backed GCI to acquire Nasstar for £79.4m

Mayfair draws equity from its second fund, which closed on ТЃ650m, to support the acquisition

Unquote Private Equity Podcast: Taking stock

Listen to the latest episode of the Unquote Private Equity Podcast, dedicated to the resurgence of take-privates

UK-focused GPs getting creative with buyout sourcing

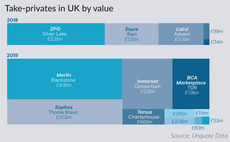

In 2019, 10 take-privates have been agreed in the UK and Ireland to date, up from five in 2018

Advent's £3.9bn Cobham take-private likely to go ahead

Advent made a takeover offer of 165 pence per share in cash, which represents a 34% premium in July

Argos Wityu to de-list EPC Groupe in take-private

Argos will back the France-based manufacturer and distributor of explosives for civil use

Thoma Bravo acquires Sophos in $3.9bn deal

Apax Partners, which holds a 10.15% stake in the cybersecurity firm, will sell its holding

Take-privates thrive amid growing pressure to invest

Public-to-private deals are back in fashion, with a record number of transactions

Lovell Minnick, Pantheon to acquire Charles Taylor in £261m deal

US-based Lovell Minnick has made an offer for listed insurance services business Charles Taylor

Advent et al. bid for ThyssenKrupp elevators division

Carlyle, CVC, KKR, and Blackstone Group are also reported to be interested in the unit

Advisory firm recommends Advent's £3.9bn offer for Cobham

BlackRock, M&G and Legal & General each hold more than 2% of shares in the aerospace company

KKR to take Axel Springer private

KKR will draw equity from its European Fund V, which held its interim close on €4.7bn in April

Cerberus to acquire Optimum Re Spain at €70.25m valuation

Cerberus first made an offer for the Barcelona-based real investment trust in July 2019

Advent International agrees £4bn take-private for Cobham

Proposed share price represents a 50.3% premium on the average value across the last three months

Bain, Carlyle place takeover bid for Osram at €35 per share

Bain and Carlyle have placed a takeover offer for the lighting manufacturer, valuing it at €3.9bn

Blackstone et al. agree £4.77bn Merlin take-private

Proposed transaction also includes co-investment from CPPIB and the investment arm of Lego

TDR to de-list BCA Marketplace in £1.9bn deal

Price gives the car auction business an enterprise value multiple of 12.5x its adjusted EBITDA