Tikehau Capital

Tikehau, BPI France invest €38m in Addev Materials

GPs back adhesives and insulates maker Addev Materials to foster European and US expansion

IDI invests €21m in Freeland

Buyout sees Tikehau providing unitranche debt for France-based support services company Freeland

Tikehau IM holds €2.1bn close across funds

Tikehau IM's four vehicles, focusing on direct lending, were launched around a year ago

Ardian, Tikehau sell stakes in Spie Batignolles

In addition, Spie Batignolles raises €190m in funding, including €67m from Tikehau IM

PE-backed Rafaut bolts on AEDS

Ace Management and Étoile ID-backed Rafaut buys France-based AEDS, doubling group turnover

Tikehau holds €350m first close for energy fund

T2 Energy Transition Fund invests in European companies operating in the field of energy transition

GP Profile: Tikehau Capital

Unquote speaks to UK head Cirenza about the asset manager's evolution and experience investing across the capital structure

Tikehau acquires Ace Management

Ace Management is specialised in the aerospace, defence and cybersecurity sectors

Tikehau, BPI France inject €150m into GreenYellow

GPs back energy supply services provider GreenYellow to support its expansion abroad

Tikehau backs Maltem

GP uses Novi 1, closed on €290m in 2015, to back France-based IT consulting firm Maltem

Ring Capital, Tikehau back Linkfluence's series-D

GPs back the social media intelligence software publisher, allowing it to buy Scoop.it

Tikehau hires BNP Paribas AM's head of compliance

Marquer will be responsible for ensuring there is an enhanced level of compliance across the group

Tikehau appoints Quagliuolo as director in Italy

Quagliuolo will be in charge of private equity in Italy, in coordination with country head Bucelli

Tikehau appoints Laillier as head of private equity

Laillier was a member of the investment and audit committees of Tikehau from 2004 to 2016

MCH buys Altafit

GP plans to support the company’s expansion with both organic roll-out and acquisitions

Tikehau holds first close, launches fund

French GP's TGE II backs SMEs across western Europe with EBITDA in the €5-50m range

Tikehau Capital backs Nexteam Group

Tikehau Capital draws equity from its mid-sized growth fund, TGE II, and the Novi vehicle

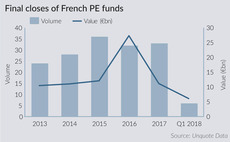

French fundraising on course for bumper year

Country has seen funds closing with a combined €6bn in commitments in Q1, more than half the total seen in 2017 as a whole

Tikehau-backed Claranet buys Union Solutions

Tikehau Capital acquired a minority stake in Claranet for an ТЃ80m equity investment in May 2017

Tikehau Capital in exclusivity for Nexteam Group

GP enters exclusive talks to acquire French metals engineering company Nexteam Group

Tikehau backs insurance broker Filiassur

GP buys a minority stake in French insurance specialist Filiassur in a €30m MBO deal

Tikehau-backed Oodrive acquires Orphea

Through the deal, Oodrive expects to strengthen its offerings to meet market demands

Ring Capital holds first close on €140m

French GP, launched in 2017, backs French tech companies in their early-stage phases

Ardian acquires majority stake in DRT

Individual shareholders and Tikehau Capital reinvest part of their proceeds alongside Ardian