French fundraising on course for bumper year

As 2018 kicked off with a flurry of fund closes, France looks well-placed to take advantage of low interest rates, a rich local source of SMEs, and a business culture that appreciates private equity's participation. Gareth Morgan reports

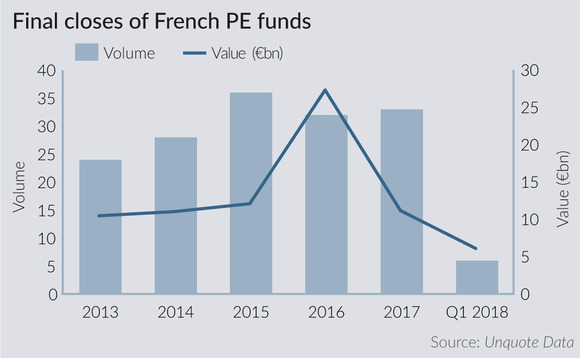

Private equity fundraising activity in France has continued to build on strong momentum since the lean years of the global financial crisis, with €11.16bn raised by 33 funds managed in France that held a final close in 2017. In terms of value, 2017 is the third highest fundraising year on record, beaten only by 2016, when 28 funds secured €30.23bn, and by 2015, when 36 funds closed €12.08bn.

Last year saw slightly more subdued activity at the top end of the market, with three €1bn+ funds holding final closes: Chequers Capital XVII closed on €1.1bn against its €1bn target, Committed Advisors raised €1.03bn for its third secondaries fund, and Apax France IX hit its €1bn hard-cap in March 2017.

Setting the tone

The first quarter of 2018 has set the tone for what is likely to be a busy year for fundraising in the region, with €6.09bn closed by six funds, including the €5bn PAI Europe VII. This is already more than half of the 2017 total value, and looking at the number of funds in the market, 2018 seems set to mark another robust year. Unquote Data lists 27 funds managed in France that have held a first close since January 2017, targeting a combined €4.96bn, including Capzanine 4 Private Debt, targeting €800m, 21 Centrale Partners V, aiming for €400m, and the €350m-target Qualium II.

This robust fundraising environment is consistent across Europe, and the same drivers apply. Globally, in a low interest rate environment, institutions are facing challenges when it comes to generating returns from traditional asset classes, and the strong track record of private equity over what is now a number of decades makes it an attractive proposition, and often the first port of call when investors begin looking at alternative assets.

Macro mirror

Typically, an underlying economy will dictate the size and shape of its national private equity landscape, and France's economy is characterised by a large number of small, boutique companies, and some large industrial and chemical firms.

"The French private equity industry mirrors the French economy," says Olivier Millet, chair of Eurazeo PME's executive board. "There are lots of smaller companies in France, and consequently there are lots of small GPs targeting smaller businesses."

With this increased level of activity at the lower end of the market, French businesses are accustomed to working with private equity from relatively early in their life cycle. "The relationship between companies and private equity firms starts very early on in France," says Millet. "Firms with €10-20m EV will partner with a sponsor and grow, and then find a new sponsor to take the step up into the mid-market. Companies will spend 10-15 years under private equity ownership, and secondary buyouts are, therefore, part of the DNA of the market."

Management play an important role in buyouts in France. They are seen as guardians of the company, guaranteeing its future vision" – Olivier Millet, Eurazeo PME

In an environment where growth for companies has historically been difficult, sponsor-owned firms have bucked the trend and have performed well. Data from France Invest shows that between 2009-2016 private-equity-backed French companies grew by 40.4%, outperforming the French nominal GDP, which grew by 15%. Over the same period, employment within these companies was up 29.9%, versus just 1.4% in the wider French economy. Net of losses, 300,000 jobs were created by private-equity-backed firms. This track record has meant that the private equity industry has developed a very good reputation among the business community in France, and management teams are active in seeking out funding from sponsors.

According to Charles Diehl, partner at Activa Capital: "Often entrepreneurs or family owners want to meet two or three private equity firms and find the right partners to take their business forwards, and will do this through an investment bank or accountancy firm."

Guardians of growth

This forward-looking tendency is typical of management culture in France, with teams having a great sense of ownership and responsibility towards their company. "Management play an important role in buyouts in France," says Millet. "They are seen as guardians of the company, guaranteeing its future vision. In this cultural setting, private equity has a specific role to play: to empower management, allowing them to keep control, but at the same time truly evolve."

Alongside a developed PE market, France's private debt space has rapidly come of age over recent years, and so local SMEs looking to grow have a huge array of financing options available. The loosening of employment regulation has made businesses more willing to take risks, and freed up capital to fund growth. Gen Oba, co-head of sales and marketing at Tikehau, says: "With constraints on hiring and firing being lowered, fixed costs for firms are falling, giving them room to look for investment opportunities."

À la mode

Across Europe, regulatory requirements are forcing traditional lenders to withdraw from leveraged finance, opening up the market to private capital. The opportunity set, along with the promise of attractive returns with fixed income-equivalent levels of risk, is drawing investors into the asset class, especially in France. "French private debt is seen as the 'opportunity-du-jour' for investors outside Europe," says Oba. "Over time, yield compression and covenant loosening in more established private debt markets, alongside developing economic stability in southern Europe, has meant appetite has shifted, and investors now see continental Europe as complementary to, if not better than, the UK."

With the French economy growing steadily, and a political regime in place committed to reforms aimed at increasing competitiveness, the future for France looks bright. International expansion is a hot topic, and a key part of Macron's election platform, and the private equity industry is adapting to this shift. "French GPs are increasingly outward-looking towards continental Europe, looking abroad to source deals," says Millet. "For some GPs in the past, France was enough." With its long-standing track record, a large number of firms ready to grow into the mid-market, and an increasing number of investors looking at the asset class, French private equity is well placed to flourish, both at home and abroad.

This article is part of our recently released 2018 France Fundraising Report. Click here to download the full report

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds