Trade sale

Fortis PE and Next Invest sell Arets to Toyo Ink for €10m

Fortis Private Equity and asset manager Next Invest have sold their joint 100% stake in Belgian ink manufacturer Arets International to Japanese ink company Toyo Ink Group for €10m.

Intel buys Aepona from Amadeus et al.

Aepona, a cloud-based telecom network solutions company backed by several venture investors, has been sold to Intel.

XAnge divests RunMyProcess stake in trade sale

XAnge Private Equity has sold its stake in French cloud computing solutions developer RunMyProcess (RMP) to Japanese trade player Fujitsu.

Axa PE sells Aixam Mega to Polaris Industries

Axa Private Equity has exited its majority stake in France-based commercial vehicles manufacturer Aixam Mega in a trade sale to US-based company Polaris Industries Inc.

LDC sells kidsunlimited for £45m

LDC has sold day care nurseries operator kidsunlimited to employer-sponsored childcare provider Bright Horizons for a cash consideration of ТЃ45m.

CM-CIC and IDI exit Alti in €75m trade sale

CM-CIC LBO Partners and IDI have sold French IT engineering firm Alti to a subsidiary of Indian conglomerate Tata in a €75m all-cash transaction.

Segulah sells Medstop to Oriola-KD

Segulah has agreed to sell Medstop Group Holding AB to Oriola-KD Holding Sverige AB for SEK 1.46bn.

Cisco buys venture-backed Ubiquisys for $310m

Small cells developer Ubiquisys, a portfolio company of Advent Venture Partners, Accel Partners and Atlas Venture, has been bought by US corporate Cisco for $310m.

Gap narrows between trade sales and SBOs

Trade sales and SBOs have posted remarkably similar figures in the past six months indicating a narrowing of the historic gap between the two types of exit.

Platinum sells Contego to FIL International

Platinum Equity has sold packaging manufacturer Contego Healthcare Ltd to FIL International Ltd for around ТЃ160m.

Isis makes 2.8x money on MLS sale

Isis Equity Partners has sold Micro Librarian Systems (MLS), a provider of library management systems to the education sector, to Capita plc.

3i and RCP exit Giraffe to Tesco

3i and Risk Capital Partners (RCP) have sold their 36.8% stakes in UK-based restaurant chain Giraffe to Tesco, giving the business a ТЃ48.6m enterprise value.

Oxford Capital exits Arieso to JDSU

Oxford Capital Partners has sold UK-based mobile network optimisation specialist Arieso to Nasdaq-listed JDSU in a $85m deal.

KKR sells BMG stake to Bertelsmann

KKR has sold its 51% stake in joint music venture BMG to co-owner Bertelsmann – a deal reportedly valuing the whole of the business at around €1.1bn.

Xerox buys Impika from Siparex et al.

A consortium of French private equity houses including Siparex, CM-CIC Capital Innovation, Turenne Capital and XAnge Private Equity have sold inkjet printing solutions business Impika to Xerox.

Isis sells LBM Direct Marketing to Stream Global Services

Isis Equity Partners has sold its stake in British data provider LBM Direct Marketing to US trade buyer Stream Global Services.

3i sells Enterprise in £385m deal

3i has sold business services provider Enterprise to Spanish infrastructure company Ferrovial for ТЃ385m.

Sun European Partners sells $72m Lee Cooper Jeans to Iconix

Sun European Partners has sold British apparel brand Lee Cooper Jeans to Iconix Brand Group for $72m.

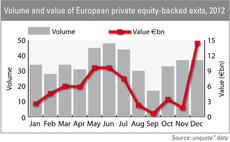

Exit market hits €15bn in December

Almost €15bn worth of capital was realised by private equity portfolio sales in December 2012, the highest amount in the past year, according to figures from unquote” data.

August sells 4Projects to TA-backed Coaxis

August has sold building software company 4Projects to US-based Viewpoint in a deal worth between ТЃ25-50m.

KKR and Permira looking to exit ProSiebenSat.1

KKR and Permira are looking to sell their stakes in German private broadcaster ProSiebenSat.1 to a trade buyer, according to reports.

Primary nets 5x on sale of Napier to Wabtec

Primary Capital has sold British turbochargers manufacturer Napier Turbochargers to US trade player Wabtec Corporation.

Halder exits Alukon

Halder Beteiligungsberatung has sold Alukon, a German manufacturer of aluminium roller shutters and door systems, to trade buyer Hörmann Group.

Summit Partners sells Ogone to Ingenico for €360m

Summit Partners has exited Belgian payment solutions provider Ogone in a €360m trade sale to listed company Ingenico.