Trade sale

DBAG exits Coperion to US trade player

Deutsche Beteiligungs AG (DBAG) and its co-investment fund DBAG Fund V have sold German mechanical engineering group Coperion to US trade buyer Hillenbrand in a deal understood to be worth €400m.

Earlybird sells BMEYE for €32.5m

Earlybird has sold Dutch medical diagnostics company BMEYE to Edwards Lifescience Corporation for €32.5m, reaping a 26% IRR on its investment.

August sells Enara for £111m

August Equity has sold UK-based domiciliary care provider Enara to listed trade player Mitie for ТЃ111m.

LDC exits Direct Group in trade sale

LDC has sold UK-based outsourced insurance services provider Direct Group to Ryan Specialty Group.

Initiative & Finance exits Nomadvance in trade sale

Initiative & Finance has sold its stake in French tracking technology specialist Nomadvance in a trade sale to Hub telécom.

Top 5 exits of 2012 so far

Top 5 exits of 2012

BWK exits Sunval in trade sale

BWK has exited German private label baby food maker Sunval in a trade sale to German dairy company DMK Deutsches Milchkontor.

HitecVision and Converto Capital sell Naxys to GE

HitecVision and Converto Capital Management have exited oil and gas equipment company Naxys to a subsidiary of American NYSE-listed General Electric.

Fr2 Capital exits Vilebrequin to G-III Apparel

Fr2 Capital has exited Switzerland-based swimwear designer Vilebrequin to listed American trade player G-III Apparel Group.

Rutland earns 1.5x on Pulse Home exit

Rutland Partners has sold branded goods provider Pulse Home Products to Jarden Corporation, a consumer goods producer.

Endless exits Phoenix Foods to Specialty Powders

Turnaround specialist Endless has sold Phoenix Foods to trade player Specialty Powders in an all-cash transaction.

N+1 makes 3.5x on ZIV sale

N+1 Private Equity has sold its 75% stake in Spanish digital equipment and services provider ZIV Aplicaciones y Tecnología to trade player Crompton Greaves for €150m.

Mid-cap GPs pay less than corporates as entry multiples drop

For the first time in two years, between April and June, private equity houses paid a lower median entry multiple than corporate buyers in mid-cap transactions, according to the latest Argos Mid-Market Index.

Perfectis exits Fasia Industries in trade sale

Perfectis Private Equity has sold its majority stake in French professional clothing business Fasia Industries to French strategic buyer Groupe Marck.

CapMan exits Ascade to CSG Systems

CapMan has sold software developer Ascade to NASDAQ-listed trade player CSG Systems.

Maven reaps 3.7x on Nessco exit

Maven Capital Partners has exited telecommunications provider Nessco Group in a ТЃ31m trade sale to US-based RigNet, generating a 3.7x money multiple on its original investment.

Nova Capital Management exits Carbolite

Nova Capital Management has sold Carbolite Holdings to Dutch tech company Verder Group in a deal generating a gross equity return of 3.5x.

HgCapital and VSS exit SHL to CEB for $660m

HgCapital and Veronis Suhler Stevenson have exited psychometric testing company SHL to the NYSE-listed trade player Corporate Executive Board (CEB) for $660m.

VCs exit Elbee in trade sale

XAnge Private Equity, OTC Asset Management and Nextstage have sold their stakes in French online home furnishings retailer Elbee to trade buyer Adeo.

3i exits Finnish outdoor brand Halti Oy

3i has sold its 49% equity stake in Finnish outdoor equipment company Halti Oy to Ingman Group.

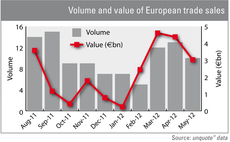

Trade sales on the rise

The partial sale of Alliance Boots to Walgreens by KKR and AXA PE is the latest in a series of exits propping up trade sale figures in 2012. Meanwhile the secondary buyouts trend is showing signs of abating. Greg Gille reports

Eurazeo PME exits Mors Smitt

Eurazeo subsidiary Eurazeo PME has exited Franco-Dutch electronic rail equipment maker Mors Smitt to US manufacturer Wabtec, reaping a 3.5x money multiple on its initial investment.

CapMan Russia exits Tascom to trade player MTS

CapMan has exited Russian telecommunications firm Tascom to local trade player Mobile TeleSystems (MTS).

VCs exit Esterel in €42m trade sale

CDC Innovation, Galileo Partners and Intel Capital have exited French software company Esterel in a €42m trade sale to US-based Ansys.