Trade sale

LDC sells NBS to TA-, Stirling-backed Byggfakta

Bank of America was given the mandate to run the sale process for the company in September 2020

LDC sells Panther Logistics to trade

LDC's Midlands team originally invested in 2016 as part of a ТЃ17m management buyout

Blackstone exits De Nora in €1.2bn deal

Sale ends a three-year holding period for Blackstone Tactical Opportunities, which owned a minority stake in the company

Equistone sells Eschenbach to trade

UK-based Inspecs Group is to pay €94.85m for the eyewear business, according to a statement

Livingbridge sells Giacom to trade

Bidders for the company included Hg among a number of other trade and private equity bidders

Omers considers sale of ERM for £2.5bn – report

Omers Private Equity acquired ERM from Charterhouse for an enterprise value of $1.7bn in June 2015

Eurazeo exits Iberchem in €820m deal

Sale generates a cash-on-cash multiple of 2.1x and a 25% IRR for Eurazeo Capital

VC-backed Spacemaker sold to Autodesk for $240m

Deal comes a year and a half after the startup raised a $25m series-A round co-led by Northzone and Atomico in June 2019

Permira hires Goldman Sachs, Morgan Stanley for Dr Martens' IPO – report

Permira acquired the brand in 2013 for ТЃ300m, with debt provided by Barclays

Altitude exits Mortec Semiconductor for 12.6x return

Altitude acquired the company in July 2016 in a deal that valued the company at around ТЃ1m

Lea Partners sells IDL to PE-backed Insightsoftware

Lea acquired a majority stake in the financial performance enterprise software business in 2019

EQT sells Tia Technology to trade

GP is selling the company for $78m in cash on a fully diluted basis, six years after acquiring it

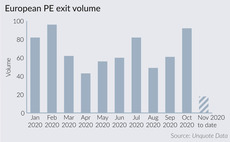

Private equity ramps up divestment efforts

Exit activity jumped by 50% in October, back to pre-pandemic levels, according to Unquote Data

Riverside sells Swedish Education Group for €18m

GP exits the business nine years after acquiring it via its 2008 fund Riverside Europe Fund IV

Epidarex sells Sirakoss to VC-backed OssDsign

Epidarex Capital initially backed the ТЃ3.1m series-A for the bone graft substitutes developer in 2014

Maven, Par Equity sell Symphonic stakes to trade

US-based Ping Identity acquires the Edinburgh-headquartered identity and authorisation software

VCs sell Flaschenpost stakes to Oetker

Investors including Cherry Ventures and Vorwerk Ventures backed the drinks delivery company

LBO France completes FH Ortho trade sale

LBO France acquired the company via its €154m Hexagone III fund in 2014

Seafort sells Noventiz Group to trade

Packaging and waste disposal compliance business was acquired by Seafort from Auctus in 2013

Rutland exits Armitage in £140m deal

Exit from Rutland Fund III realises a return of 5.7x on the original cost of the investment

BGF sells stake in Chase Distillery

BGF bought a minority stake in the gin and vodka producer in 2017

Cornerstone Capital exits EppsteinFoils to trade

GP invested in the metal foils producer, then known as Stanniolfabrik Eppstein, in 2008

HTGF, Evonik exit Synoste to trade

Deal is HTGF's 11th exit during the coronavirus pandemic, and comes seven years after the VC first invested in the company

HTGF, Bayern Kapital exit ChromoTek to trade

VCs invested in the nanobodies developer in 2010; ChromoTek has been sold to a US-based market peer