Analysis

HSBC expects dealflow uptick and higher returns with second direct lending vintage

Second vintage expects to build on USD 580m in current commitments, with first deal expected in July

GP Profile: Bregal Milestone explores generative AI opportunities for portfolio companies

Plans seven further deals from recently closed EUR 770m fund

Women in VC: Lima Ventures' Argun on exit plans and gender-equal investing

Turkish VC firm manages three funds, including Alima, which helps its portfolio companies attract global investment

From slash-and-burn to grow-and-earn: private equity changes tack

Rising cost of capital means value-creation will be vital for next decade of private equity, SuperReturn participants said

GP Profile: Limerston Capital anticipates higher volume but more complex M&A as market steadies

UK-based GP is seeing dealflow driven by carve-outs and buy-and-build in a market where organic multiple arbitrage is no longer a given

Unquote Private Equity Podcast: In conversation with... Fabio Ranghino, Ambienta

In an interview with Unquote, Ranghino discusses topics including ESG and the next phase of Ambienta’s growth

LP Profile: Lennertz & Co gears up for new tech impact venture fund-of-funds

German family office’s new strategy is set to launch this year with a EUR 50m-EUR 100m target

Women in PE: Innova Capital's Pasecka on consolidation and succession opportunities amid macro challenges

Magdalena Pasecka discusses the Polish GP’s fundraising and deployment plans, as well as advice for emerging leaders in the industry

European VCs need to match actions to words by increasing funding to female-led companies

Women-led startups usually receive less than 2% of VC capital, but more diverse, defensible female-founded businesses emerging

GP Profile: Investindustrial eyes near-shoring opportunities as third growth fund closes

GP closed its latest fund within a 12-month period on the road with strong support from European LPs

Unquote Private Equity Podcast: Taking the plunge - GPs dive into alternative pools of capital

The Unquote team is joined by Thomas EskebУІk, CEO of private markets platform Titanbay, to discuss private marketsт search for alternative sources of commitments

Women hold 12% of senior investment roles in UK-based PE and VC firms − survey

BVCA and Level 20 report shows more progress in junior and mid-level cohort versus senior, and no black women in senior roles

GP Profile: Ardian Expansion doubles down on generalist approach, eyes EUR 3bn Q2 fundraise launch

With its current EUR 1.5bn fifth fund almost at full deployment, Ardianтs Expansion strategy expects to benefit from LP appetite for its strategy ahead of EUR 3bn fundraise

VC Profile: Klima lines up green energy deals from EUR 210m debut fund

Franco-Spanish Alantra and EnagУЁs-backed VC initiative expects to lay the foundations for its second fund in 2024

Women in VC: MMV's Brunet on tech opportunities and navigating volatile markets

Alix Brunet speaks to Unquote about the VC firmтs deal pipeline and how it is engaging with portfolio companies and new founders

VC Profile: HTGF optimistic on seed stage opportunities as exit environment toughens

German seed investor secured almost EUR 500m for its fourth and biggest fund to date at a time when VC funding is slowing down

Slice of pie: New entrants gobble up GP stakes in Europe

Armen, Hunter Point Capital, GP House and Axa IM rustle up new minority investments, as Inflexion and Coller sell

GP Profile: Opera Investment Partners doubles fund size with EUR 200m target for next vehicle

Fund I тalmost fully committedт with one exit completed and two-three more realisations expected in the next 18 months

Women in PE: Foresight's Alvarez on SME deployment plans, regional expansion drive

Partner Claire Alvarez speaks to Unquote about opportunities in the current market and the UK-based sponsorтs diversity ambitions

Podcast: Q1 2023 - Bank runs, fund home runs and markets come undone

Unquoteтs reporting team discuss themes that have arisen in Q1 2023, ranging from liquidity management to venture and growth activity

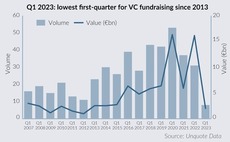

VC fundraising sinks further with lowest Q1 in a decade

Eight European firms secured just over EUR 2bn in commitments in Q1 2023 as continuing uncertainty suppresses LPsт risk appetite, but fundraising pipeline looks promising

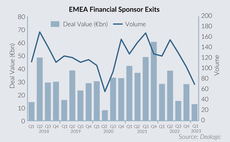

Spending bottom dollar: Valuation gaps take Q1 buyout levels back to 2009

Sponsors make just 95 buyouts in Europe in the first quarter - a figure not seen since Sony sold 12m floppy discs in one year

PE roll-up strategies face regulatory heat with focus on consumer industries

With longer holding periods facilitating more bolt-ons, regulators including the UK's CMA are intervening

VC Profile: Hi Inov in pre-marketing for next fund, outlines plans to wrap up Fund II investment period

France and Germany-based early-stage investor has made 15 of its up to 20 planned investments from its EUR 100m Fund II