Slice of pie: New entrants gobble up GP stakes in Europe

Once a cake eaten mostly by North American investors, new connoisseurs have started getting a taste for small stakes of private equity (PE), credit and infrastructure general partners (GPs) in Europe.

Last month, one of Europe's emergent players, French fund Armen, held a first close of EUR 150m on its inaugural fund, which will make 12-15 investments in GPs with up to EUR 10bn in assets under management (AUM).

Meanwhile, firms such as UK-based GP House and a new division of Axa Investment Managers are starting the prep work to bake similar deals.

PE, private credit and secondaries managers are all tasty targets, with new US-based investor Hunter Point Capital making a foray into Europe with investments in Inflexion and Coller Capital this month.

Ingredients for success

A GP stake typically sees an investor take a 10-30% passive or active stake in a sponsor, which will give it access to lucrative management fees and future carry. Meanwhile, the vendor gains some liquidity on its balance sheet and achieves some valuation objectives.

"GPs are increasingly trying to solve multiple objectives at the same time," said Antoine Dupont-Madinier, a managing director with Lincoln International's Financial Institutions Group. These can include partial monetization (de-risking without losing control), planning for succession, funding growth or increasing co-investment requirements, he said, adding that deals can involve primary or secondary issuance or some combination of the two.

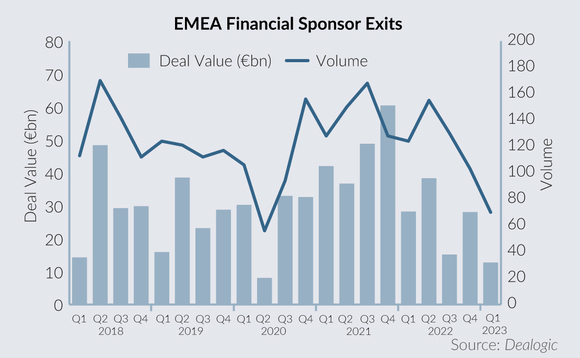

An extra serving of liquidity is particularly palatable in the current trading environment, as a large drop-off in PE exits has seen less capital returned to vendors and limited partners (LPs). It can also help GPs raise commitments to their own funds amid a difficult fundraising environment.

In the year-to-date (YTD) for 2023, PE exits in Europe are down 61.59% compared to the same period last year, according to Dealogic data. This is the lowest YTD result since 2013.

Serving up

The renewed taste for GP deals in Europe does raise questions about how stake buyers can have their cake and eat it - some sponsors that have sold stakes in their own vehicles have later ended up fully selling to a consolidator.

UK-based alternative asset manager Arcmont sold a controlling stake to US peer Nuveen three years after it sold a GP stake to Dyal Capital; while Basalt Infrastructure Partners sold to Colliers last year, after Wafra took a GP stake in 2016.

Others have decided to go the IPO route, including Bridgepoint's 2021 listing following a stake sale to Dyal in 2018. CVC also sold a stake to Blue Owl in 2021 and has been planning for an IPO in Amsterdam.

The GP stakes market is fairly sizeable globally across players operating at different size brackets. Meanwhile, in Europe, it is slowly becoming the taste du jour.

Recent GP stakes deals in Europe:

| Buyer | Vendor | Type | Date |

| Hunter Point Capital | Coller Capital | Secondaries | Apr-23 |

| Hunter Point Capital | Inflexion | Private equity | Apr-23 |

| Blue Owl | CVC | Private equity/ Private credit | Aug-21 |

| Opac | Nordic Capital | Private equity | Sep-19 |

| Blackstone | BC Partners | Private equity | Aug-19 |

Source: Unquote

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds