Analysis

Deal in Focus: Kartesia in Desmet Ballestra debt-for-equity swap

unquote" looks back on alternative lender Kartesia's progressive takeover of the Belgian-Italian group

Deal in Focus: Quilvest exits Acrotec in uncertain Swiss watch market

An in-depth look at the recent sale of watch component maker Acrotec by Quilvest to Castik

Lack of Nordic exits a sign of weak portfolios, says Altor's Mix

Conditions in the Nordic markets could hardly be better for private equity exits, Harald Mix said at a conference

Nordic mid-market mezzanine's malaise

Mid-market mezzanine has been all but entirely squeezed out of the Nordic private equity space

New rules for Italian debt create opening for alternatives

Italy opens up its credit market to European alternative investment funds

Deal in Focus: Omnes exits Sateco after nine years

Despite a troubled construction market, Omnes rode out the storm and exited Sateco as activity returned

In Profile: LDC

unquote" takes a closer look at LDC in light of the captive's explosive deal activity in recent months

Q&A: Private Equity Partners' Fabio Sattin

Fabio Sattin says Italy is opening up to alternative lenders and hybrid instruments

Abundant dry powder fires secondaries prices sky high

This second installment of our secondaries focus takes an in-depth look at pricing trends

Prime-time for secondaries

The secondaries segment has clearly been popular with LPs, but can it cope with mounting levels of dry powder?

Deal in Focus: Orkila taps European craft beer with Mikkeller deal

Growth investment from the US speciality investor marks the first private equity investment in European craft brew

CEE private equity confidence rebounds

Despite low dealflow in 2015, PE confidence in central, eastern and south-eastern Europe is rebounding to more normalised levels

Reputational risk continues to haunt Swedish private equity

Increasing attention from the media, regulator and politicians means Swedish firms must invest responsibly and highlight their growth credentials

Co-investing with corporate venture is not without its pitfalls

Venture capital firms can benefit from cooperation with CVCs but must be wary of those that value strategy over returns

PE & VC key for French economy, says minister Macron

Speaking at the Afic Annual Conference 2016 in Paris at the end of May, Emmanuel Macron had kind words for the industry

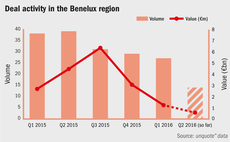

Usual suspects working hard in sedate Benelux market

Trend of declining dealflow in the region shows little signs of change, though buyout multiples return towards lower long-term averages

Generational turnover makes PE in Italy more pressing than ever

Succession challenges and internationalisation opportunities are drastically altering the Italian dealmaking environment

British investors hold fire as EU vote looms

Dealflow and aggregate value drops to 2009 levels as uncertainty puts private equity firms' plans for UK investments on hold

In Profile: IK Investment Partners

Having recently returned to the small-cap space, unquote" takes an in-depth look at the firm's overall strategy, fundraising, deals and team

VC financial engineering fuelling tech bubble?

Downside protection in later VC-backed funding rounds is increasingly presented as justification for growing valuations

Deal in Focus: Astorg sells Ethypharm after nine-year holding

Resisting regular suitors, the GP's nine-year tenure of the pharmaceutical company allowed it to fully implement a long-term acquisitive strategy

Cast adrift: What next for PE-backed oil & gas companies?

Exit opportunities for funds exposed to the oil & gas market have been severely impacted by the drastic drop in oil prices over the past two years

Nordic PE must focus on reputation and responsibility, says EQT's von Koch

EQT managing partner Thomas von Koch spoke as keynote at todayтs unquote" Nordic Private Equity Forum in Stockholm

Deal in Focus: Montagu acquires August's FSP

Tertiary buyout will pave the way for further consolidation of the funeral services market, which has proven highly popular among PE players