Analysis

From US to Europe: an elusive carried interest definition

Carried interest

Matas to unlock the Nordic IPO market?

The recent IPO of Matas, with a market cap of тЌ630m, is the first new listing on the Copenhagen stock exchange in two years. Could this listing be the key to unlocking the hushed Nordic IPO market? Karin Wasteson investigates

Casual dining; the proof is in the branding

Casual dining

Key to UK mid-market growth is overseas

According to new research, the UK mid-market is more than weathering the storm. This key segment, which has been touted as vital for putting the economy back on track, is one of the biggest contributors to UK GDP through its drive to sell into new geographical...

Q&A with Hassans partner James Lasry

Q&A James Lasry

VCs reach for the cloud

Silver linings

Mark Florman defines ERR; Awards deadline Friday

Video: Mark Florman

Q&A: Duke Street's Buchan Scott

Q&A: Duke Street

Private equity's public impact: Q&A with EVCA chair George Anson

Q&A: George Anson

Private equity's trepidation over European shale

The US shale gas revolution has transformed the countyтs energy market, not only reducing imports but also significantly decreasing the cost of gas. This phenomenon has surely raised a few European investor eyebrows, wondering how to benefit from similar...

UK tech investments: opportunities and pitfalls

The UK's tech space might be once again a target of choice for private equity, but speakers at a Taylor Wessing seminar recently warned investors to tread carefully to make the best of the good times ahead. Greg Gille reports

Tackling transparency and disclosure through data

While GP monitoring of portfolio companies becomes more sophisticated, LPs are demanding more granular insight into individual fund performance. The increasing demand for performance information begs several important questions: What data is required?...

Iceland's venture scene soon to erupt

Iceland may have been at the forefront of the financial crisis, but its start-up activity is beginning to boom. Karin Wasteson investigates

The challenges of regional investing

Regional investing often means more opportunity for relationship-based deal doing, as highlighted in yesterday's story. But there are also challenges, as we explore here in the second installment of Alice Murray's two-part series.

Regional UK players closing the gap on London market

Life outside London

Recipes for success in Asian markets

PE in Asia

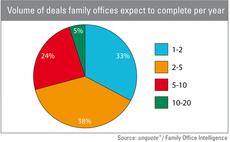

Family offices seek surge in deal origination

Family offices

Pricing secondaries: complex process or pure guesswork?

Pricing secondaries

German VCs saying: "Ich bin ein Berliner"

For firms looking to set up shop in Germany, selecting the right city can prove challenging. Amy King argues the case for heading to Berlin

High-yield Q&A: Lloyds' Ian Brown and David Whiteley

High-yield Q&A

Waiting for the direct lenders

Direct lenders