Analysis

The changing face of fund manager selection

GP selection

Return of the capital overhang?

Capital overhang

UK consumer sector exits at record levels

The number of UK consumer goods assets divested by private equity firms is at its highest level in 10 years despite the continued desolation suffered by the consumer market.

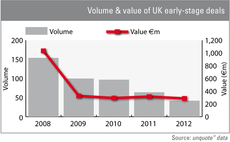

Value of UK early-stage investments holds steady

UK early-stage deal numbers are dropping off, but the total value invested has held steady over the last four years.

The importance of being European

EU membership

Monetising life sciences deals

Life sciences

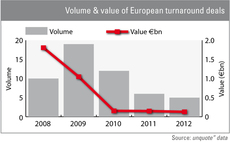

Turnaround deals hit five-year low

Turnaround deals

AP6's Swartling on strategy, regulation and CSR

Karl Swartling, CEO of AP6, discusses the Swedish government’s Langensjö inquiry into state pension funds and its recommendations for drastic saving measures. How will it affect AP6 and how best to prepare for the changes?

Swedish venture faces critical funding gap

When it comes to venture capital, opportunities abound in Sweden. Yet, despite the success stories, a critical funding gap threatens the future of the industry. Amy King reports

Holding periods stretching amid tough exit environment

Holding periods

Nordic private equity hushed but hopeful

Nordic PE

SMEs want UK to stay in EU – KCP survey

More than three-quarters of SME managers want the UK to remain part of the European Union, according to research conducted by private equity house Key Capital Partners (KCP).

PE and trade players neck-and-neck on mid-market pricing

Mid-cap valuations

Q&A: Alberto Forchielli, Mandarin Capital Partners

Founding partner Alberto Forchielli speaks to Amy King about expectations for the firm's current fundraise, why Germany is the only option left for Chinese industrial investment and Chinese GPs’ lack of international presence.

Sovereign wealth funds to shape the future of PE

Sovereign wealth funds will be a major LP group in 20 years’ time, according to a panel at the Guernsey Funds Forum 2013. Amy King reports

Swedish GPs cash in on pharmaceutical reform

Swedish healthcare bonanza

Capital gains tax overhaul welcomed by Afic

French CGT

German activity sluggish despite mega-deals

German activity

Italian merchant bank begins direct PE investment

Italian turnaround

CEE: Under-marketed and overlooked?

Central & Eastern Europe is a strong performer over a 10-year investment horizon, but investors remain wary. Is it time to take another look at the region? Kimberly Romaine reports from Warsaw

Q1 activity hits five-year low

The UK & Irelandтs first-quarter activity levels are at their lowest level for five years, according to the latest research from unquoteт data.

Afic: France needs urgent PR boost

French PE