Family offices seek surge in deal origination

Despite an ever-growing appetite for direct investments, family offices aren't seeing enough quality deals, writes Investec's David Currie.

It may seem obvious, but whenever we talk of investment appetite or seek to assess the mood of the market, we always come back to the same home truth – investors need access to quality deals.

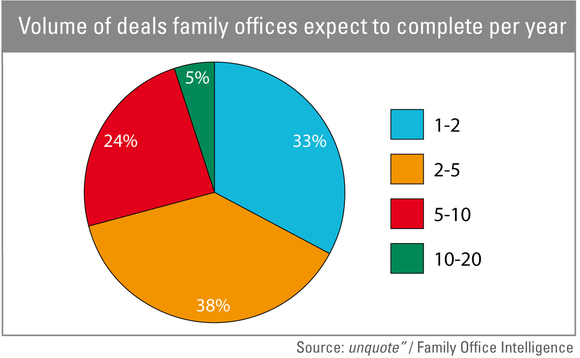

The figures unearthed in the Family Office Investment In Private Equity survey raise almost as many questions as they answer; be it the desire expressed by family office respondents to see more deals in the oil and gas sector, to the hugely optimistic view that two-thirds of family offices hope to complete one to five deals this year, yet most surveyed view fewer than 20 investment opportunities per year.

When asked at the Family Office Investment Summit earlier this year why they may not achieve their desired number of direct investments this year, 57% of the audience responded saying it was the quality of the deals presented that was slowing down their progress (quantity of deals and costs of transacting lagging way behind on 5% and 10% of the vote respectively).

With regards to sector preference, the audience indicated that familiarity with the sectors they are investing in coupled with current market trends and the anticipated return of certain "hot" sectors were the main drivers of investment.

This puts immense pressure on family offices' deal-doers, constantly trying to find the ideal investment opportunities that allow them to exploit the family's historical industry knowledge in what they believe to be the sectors that will form the economy of the future.

Ultimately though, it all boils down to dealflow and without access to high quality deal origination, expertise and desire alone will not complete successful deals.

Deals forecast

To many professionals' surprise, respondents of the Investec Family Office survey are bullish on private equity deals considered and completed. 38% of the professionals surveyed are considering more than 10 deals per year while 29% wish to complete more than five deals a year

Other key findings

- Family office investors in private equity are predominantly single and multi-family office operations with in-house investment management capabilities that seek a capital growth over a medium to long-term horizon.

- They look for investment growth opportunities in Asia but remain committed to the traditional investment destinations of western Europe, the US and the UK.

- Investors have a strong preference for listed equities but the survey shows a fair amount of consideration to potentially invest in debt-related products and private equity funds.

- Investors demonstrate a strong appetite to complete deals.

- A majority of respondents are considering co-investments alongside family offices and private equity firms.

Click here to view the full Investec Family Office Investment In Private Equity survey.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds