Analysis

BVK calls on industry to remain calm on regulation

Despite its economic importance, the German private equity industry is struggling against a tide of regulatory pressure and a hostile political environment. But the BVK says despite recent negative publicity, new regulations are not set out to destroy...

Rethinking LP funds

Alternatives to LP funds, such as listed private equity and deal-by-deal, are all gaining in popularity as their merits become more obvious in today's backdrop. Kimberly Romaine reports

unquote" regulation update: AIFMD

In this week's unquote" regulation update, Anneken Tappe looks at the latest developments surrounding the Alternative Investment Fund Managers Directive.

Private equity set to take centre stage in Italy

The current lack of bank lending for family-run SMEs spells good news for Italian private equity. But a growing focus on innovation might also give venture a much-needed boost. Amy King reports

Matrix hits grand slam for deals, exits in 2011

As the downturn drags on, most GPs are laying low and hoarding cash. One small buyout house stood out for achieving four investments and four new exits in 2011 т and has just announced its independence. Kimberly Romaine reports

BGF: "We are not scraping the bottom of the barrel"

Business Growth Fund (BGF) chief executive Stephen Welton today addressed concerns about the fundтs approach to financing small UK businesses. Greg Gille reports

Creative industries perceived as risky business

Unquoteт data reveals that the volume of investments in the creative industries has fallen while their value has risen. Investor risk aversion amidst economic volatility could be behind the fall in volume in a sector commonly perceived as risky business,...

French mid-market continues steady climb

French mid-market buyouts staged a startling recovery last year, confirming that the 2010 uptick wasn’t a fluke – but can they keep climbing back to historical levels in the face of a tough environment? Greg Gille reports

Swiss tax treaties could open doors for further crackdowns

Sweden is the latest European country to sign a Rubik tax treaty with Switzerland. Sonnie Ehrendal reports

VCT MBOs must continue, says ICAEW

Proposed changes may strip VCTsт of their ability to back buyouts т but this would have dire consequences, according to ICAEWтs CF head. Kimberly Romaine reports.

Regional investors vital for economic recovery

Regional devolution has been favoured by some private equity firms as a means of boosting dealflow. However, despite the merits of a regional presence, unquoteт data reveals that investments backed by regional players has fallen since 2005. Perhaps though,...

Disregard for antitrust compliance challenges PE

Antitrust allegations can lead to serious legal and financial struggles for GPs. Yet, antitrust compliance is still not a hot issue in private equity, according to Baker & McKenzie. Anneken Tappe reports

Sweden tops EC innovation despite incomplete eco-chain

Sweden has ranked highest in the European Innovation Union Scoreboard, but one industry professional has expressed his surprise at this success due to an тobvious lack in strategy for innovationт and тa terrible taxing system for entrepreneursт. Amy King...

Mid-cap valuations still stuck on pre-crisis levels

Activity nosedived in the second half of 2011, but the flight-to-quality phenomenon translated to very little movement on the entry multiples front. Greg Gille reports

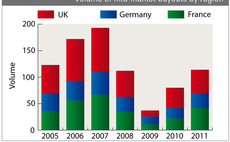

Corporate divestments decline across Europe

As industry players remain cautious with regards to dealflow, unquote” data shows that the trend in domestic corporate divestments is heading downhill. Anneken Tappe reports

Could venture capital cure youth unemployment crisis?

Unemployment is rife in Southern Europe. Particularly afflicted are the younger members of society, unable to enter the impenetrable job market. But could venture capital play a part in lightening the heavy burden of youth unemployment in the Mediterranean?...

AFIC calls for staff stakes in PE-backed firms

French private equity trade body AFIC has drafted a proposal to simplify and extend the incentivisation mechanism for employees of PE-backed businesses.

DACH venture scene remains on top form

While the rest of Europe has suffered from a low deal volume in 2011, the DACH early-stage sector is going strong. Considering the well-established venture scene, it is not surprising that this region has dominated early-stage in Q4 2011.

Dodd-Frank fears "overblown"

The extensive requirements and wide reach of the US's Dodd-Frank Act has stirred up fears among European GPs. But law firm DLA Piper downplays worries, pointing to a number of available exemptions. Sonnie Ehrendal investigates.

Market consolidation forcing FOFs to evolve

Funds-of-funds are an endangered species, with many shedding the title. Kimberly Romaine finds that today itтs all about diversification and tailoring your offering to prospective clients.

Fragmented ecosystem hampering European venture

The debate surrounding the high returns enjoyed by Silicon Valley investors compared to their European counterparts continues. But why do stateside investments traditionally reap higher returns than those in European startups, and what needs to change...

Could high-yield bonds tackle the refinancing wall?

The wall of refinancing, the burden of LBO debt set to mature in the next two years, is uncomfortably close, leaving the private equity industry to come up with a new structured product to preserve the credit line. But as the industry looks towards the...

Introducing unquote" analysis

In the next few days a new magazine with a familiar logo will be landing on the desks of private equity professionals across Europe, unquote” analysis.

French presidential election spells bad news for PE industry

The regulatory landscape is getting tougher across Europe for private equity - but French players might have more to worry about than most, as presidential candidates unveil measures that could affect the industry. Greg Gille reports