Could venture capital cure youth unemployment crisis?

Unemployment is rife in Southern Europe. Particularly afflicted are the younger members of society, unable to enter the impenetrable job market. But could venture capital play a part in lightening the heavy burden of youth unemployment in the Mediterranean? Amy King investigates.

Spain calls them mileuristas, temporary workers earning at most €1,000 per month. In Italy they are the precari, so-called due to the precarious nature of their temporary work contracts, and in Portugal they are the geração nem-nem, the "neither nor generation" - both out of work and education.

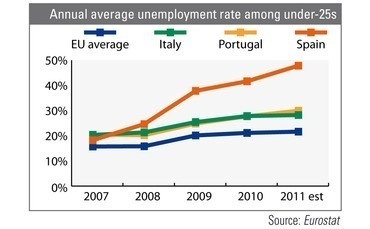

Since the onset of the financial crisis youth unemployment has risen perniciously across Europe. In Spain, Portugal and Italy a combination of investor aversion to risk and the unshakeable job security enjoyed by older "insider" employees are making the local job market almost impossible to break; in the third quarter of 2011 youth unemployment stood at 47.8%, 29.9% and 28.2% in Spain, Portugal and Italy respectively. But what part can venture capital play in anchoring these soaring figures in the badly-hit Mediterranean?

After the success of Silicon Valley, the hand venture capital plays in igniting entrepreneurial flare and creating jobs seems undeniable. According to research carried out by the Kauffman Foundation examining the economic impact of entrepreneurship, between 1980 and 2005, firms less than five years old created 40 million new jobs - 100% of the net new jobs created in the entire American private sector. Elsewhere, seed investments in start-ups saw the Israeli economy grow with remarkable vigour.

Capital creates careers

In Spain, according to research carried out by the Spanish venture capital association ASCRI, the 94 companies that received initial stage venture capital funding in 2005 reported an average increase of 10% in workforce numbers in 2005-2008 and sales growth of 42.5%. Those without venture capital backing were noticeably worse off. Since start-ups are usually the domain of younger members of society, does it not follow that a culture that fosters innovation could reduce youth unemployment?

According to a recent study carried out by the University of Bath, it does. The study found that if Italy had the access to venture capital funding that the US enjoys, youth unemployment would fall. The Italian Prime Minister Mario Monti appears to heed this criticism and has frequently acknowledged the difficulty Italian SMEs face when accessing venture capital; his government appears to be making moves to clear the obstacles they encounter.

To begin with, the government-backed Fondo Italiano has recently announced plans to invest in venture capital funds. Meanwhile, the Youth Department of the Italian government is set to promote start-ups through collaboration with Italian universities and the creation of accelerators, spaces that bring entrepreneurs into contact with experts and venture capitalists. Monti has also recently introduced reforms to facilitate access to venture capital for Italian companies launched by under-35s as part of the government's liberalisation plans. Similar recognition is rising in the Iberian Peninsula; ASCRI president Maite Ballester recently announced the association's plans to propose economic reform to the Spanish government to encourage venture capital investments.

Venture capital is not the sole solution to unemployment, but is a step in the right direction. While venture capital allows a start-up to operationalise and hire new staff, unemployment levels take a real hit in the expansion stage often funded by larger private equity investments.

Changing attitudes

However, it seems that a cultural shift towards innovation fuelled by venture capital needs to occur in Southern Europe for two reasons. Firstly in order to re-attract international private equity investors who have been deterred by the unfavourable climate in Southern Europe but who have the capital to grow a company from a start-up through expansion and create a larger number of jobs. A venture capital boost is also needed to halt the rising emigration of young talent in the Mediterranean; Southern European countries are losing their graduates to more favourable job markets abroad.

After a sustained period of strong growth prior to the crisis, young Spaniards are disillusioned with a country that had promised them jobs after graduation. Italians on the other hand have a more fatalistic attitude, choosing to leave behind a country that has not experienced economic growth for quite some time. Portuguese youth see themselves as part of a lost generation, unable to find work. Perhaps a heavier focus on venture capital could promote the climate of innovation and entrepreneurship needed to plug the Mediterranean brain-drain.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds