News

Montagu-backed intel provider Janes attracts takeover interest amid defence spending boom

Formal auction for the security and defence intelligence specialist unlikely to start before early 2024

Wellspect bidders CVC, KKR, PAI, EQT expected to progress into second round

US trade owner attempted a previous sale for the Swedish bladder and bowel-control products specialist in 2018

Houlihan Lokey hires new capital markets MD from Numis

David Kelnar told Unquote that the firm is seeing a growing pipeline of companies looking to fundraise

Hunter Point buys minority stake in Coller Capital

Proceeds from the deal will be invested into secondaries investor Coller Capitalтs funds

LDC appoints Houlihan Lokey for Kerv sale

LDC backed IT managed services firm's formation via a two-company merger in 2020 with a GBP 30m investment

MJ Hudson business divisions acquired by Apex Group

Sale follows suspension of listed UK-headquartered asset management service providerтs shares in December 2022

DC adds to secondaries practice with former Mercury Global hire

Sabina Sammartino joins the investment bank around six months after its GP-leds team was launched

Alcentra revives direct lending push with multi-billion fundraising drive

Direct lender registered its fourth European fund in Luxembourg in January 2021

Inflexion sells GP stake to Hunter Point Capital

10% stake in UK-based midmarket sponsor is the first European deal for US-based GP stakes investor

V.Group sponsor Advent explores strategic options, appoints Goldman Sachs and Jefferies

Sponsor bought the UK-based marine servicing firm from OMERS Private Equity six years ago

Infravia aims to raise up to EUR 1bn for next growth fund, eyes mid-2024 launch

French sponsor expects to raise EUR 750m-EUR 1bn for B2B tech-focused second growth fund

Dechert bolsters Munich PE practice with WilmerHale hire

New partner Kai Terstiege joins law firm’s recent private equity hires including counsel Tobias Hugo

Sun European Partners appoints DC Advisory for Wescom sale

Sponsor bought the UK-based marine and defence pyrotechnics manufacturer from PE-backed Drew Marine in 2020

Bowmark Capital distributes IMs for Lawyers On Demand exit

GP backed the MBO of the UK-headquartered legal services and tech consulting platform in 2018

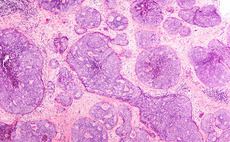

Large-cap sponsors circle Qiagen bioinformatics arm ahead of indicative bids

Potential PE bidders are assessing performance and market share of the Netherlands-headquartered business

Newton Biocapital heads for year-end close for second, EUR 150m life sciences fund

Belgian-Japanese VC has raised EUR 50m to date and is lining up exits from its debut fund

Half of LPs allocating to impact from generalist pool as market matures – Rede Partners

Jeremy Smith and Kristina Widegren speak to Unquote about key takeaways from the private capital adviserтs Private Markets Sustainability and Impact Report

Caverion minority shareholders cautious on rival bid upside as Bain mulls options

Listed Finnish construction company has received takeover offers from Triton and Bain Capital

Sofinnova launches digital medicine strategy

Life sciences sponsorтs sixth strategy will deploy EUR 2m-EUR 8m tickets in seed and Series A

Cinven's indicative EUR 10 per share Synlab bid seen as below fair value

Sponsor listed the laboratory testing service provider at EUR 18 per share in 2020

Synova's Clyde Munro exit parked in waiting room

Dental clinic sale could resume with improved macro conditions and after post-acquisition trasing plays out

Nation 1 launches new early-stage, EUR 35m-EUR 40m fund

Czech investor targets first close in 1Q24, seeking to attract institutional investors and at least one bank

Great Hill opens London office to expand activity in Europe

Managing director Drew Loucks will head Boston-based PE firmтs new arm

The Bolt-Ons Digest – 20 March 2023

Unquote’s selection of the latest add-ons with Cinven's ETC, PAI's Apleona, TA Associate's Fairstone, and more